The crypto space has an uneventful last week from a pure performance perspective, but a number of spot $ETH ETFs launched.

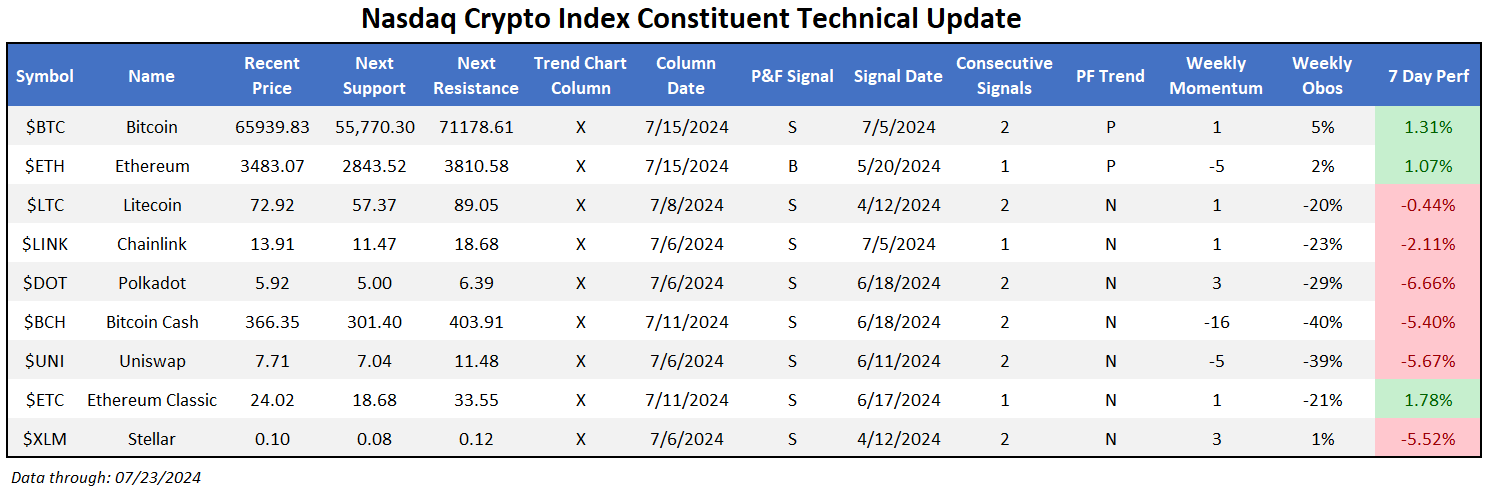

The crypto space had an uneventful last week from a pure performance perspective. A handful of coins within the Nasdaq Crypto Index (.NCI) found themselves slightly in the red while larger coins, namely Bitcoin ($BTC) and Ethereum ($ETH) posted small weekly gains. For the most part, technical pictures within the crypto space remain largely in limbo. Bitcoin’s recent rally is constructive but several other coins have broken down to significant levels of support. All in all, continue to exercise caution as you look towards investable options within crypto.

While performance metrics were somewhat muted, this week did bring the launch of several spot Ethereum ETFs to the market. This follows a slew of spot Bitcoin ETFs to open in 2024, which is typically considered a positive sign as access to crypto increases for open markets. On the first day of trading, spot Ethereum ETFs saw over 100 million net inflows, let higher by Blackrock’s ETHA. From a technical perspective, $ETH is in the middle of a notable line of support established below around $2,850 and a range of resistance up above around $3,800-$4,000. While more constructive than other coins which have moved notably lower, a third failure to breech these highs could spell further weakness for the coin.