How Long Can Bitcoin Bounce Around All-Time Highs?

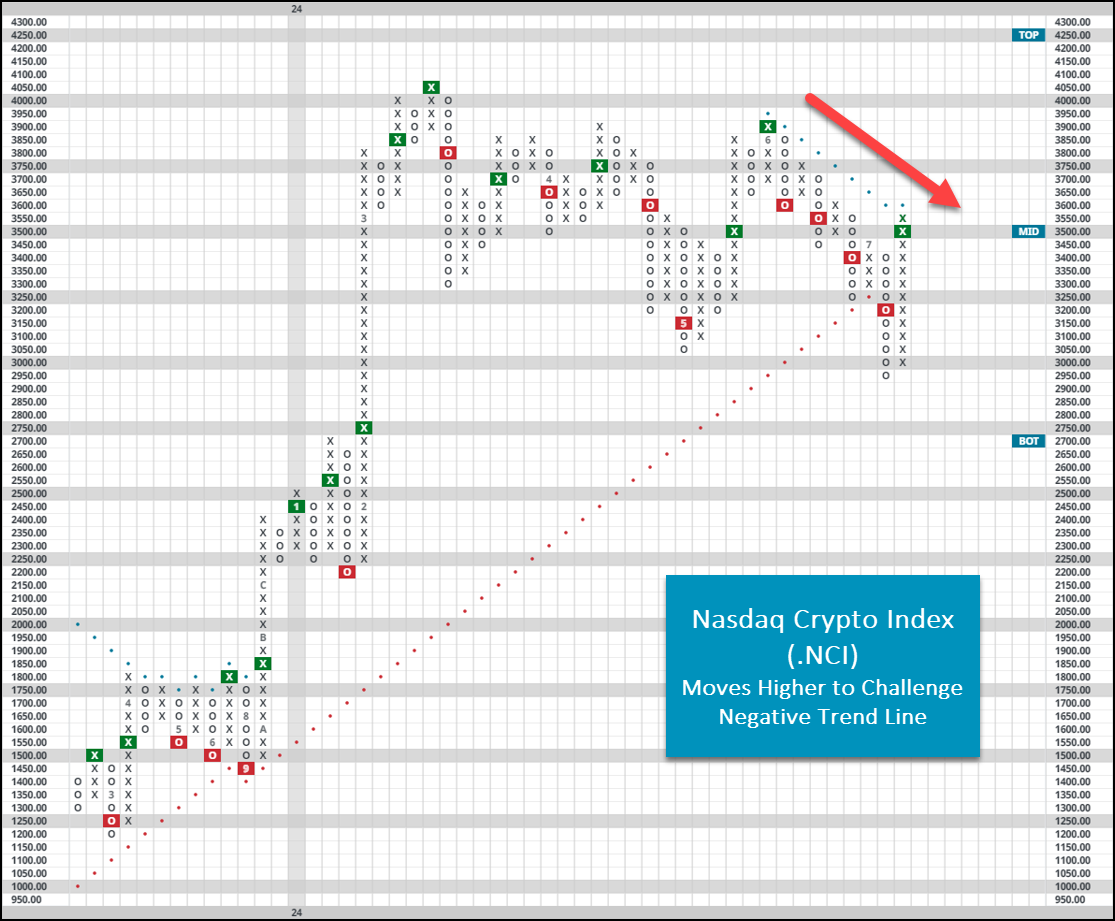

The crypto space moved largely higher over the last seven days as the odds for a Trump presidency surged higher following last weekend's events. While many constituents of the Nasdaq Crypto Index (.NCI) put in place double-digit positive returns, the upside action was somewhat limited from a purely technical perspective. In most cases, action saw coins reverse back up to the middle of their respective trading band, a net positive but not quite enough to change the overall fragility of the crypto industry's recent action. Bitcoin surged back up above $60,000, a point bulls will watch closely in the near term to see if buyers entrench themselves around that level once again. Much like action on the domestic equity front, upside participation was broad enough (smaller coins joining in) to see .NCI move higher on its default chart. The index posted its first buy signal since late June, challenging its negative trend line above. This echoes similar themes as mentioned before- positive… but there is still work to be done before one could safely say crypto’s rally is back on.

With Bitcoin moving back up above $60,000, it brings the crypto king just outside of 10% off its all-time highs back from March of this year. While it certainly feels like things have stagnated around this mark for quite a while now, historically Bitcoin has shown several instances of prolonged action (defined below as 30 days) around all-time highs. Its most recent streak ended in mid-June at 32 days. Since 2015, there have been six other instances of extended action around those all-time highs, the longest coming in 2016 at a total of 80 days. While this study is admittedly simple, performance metrics following these streaks reveal quite a compelling story. Near-term returns following the end of such a streak are significantly worse than the “average” for those time frames, while more intermediate to longer-term timeframes boast excess returns over “normal” circumstances. Said otherwise, near-term results are typically rocky (like we saw most recently in June) while longer-term results have perked up quite nicely. Each instance comes with its own unique set of circumstances, and previous reports have already touched on the rocky technical picture emerging within the crypto space this time around. Keep this idea in mind as Bitcoin continues to bang up around respective all-time highs… it can often last longer than you may expect.