While the broad market stagnated in the second quarter, the mega caps continued to do well. The Invesco S&P 500 Top 50 ETF ([XLG]) gained 8.59% while the S&P 500 Equal Weight Index ([SPXEWI]) declined 3.09% in the second quarter.

Curious as to where the "Weight of the Evidence" stacks up across asset classes to start the second quarter? Check out NDW's update for Q2 2024, discussing where markets stand to open the back half of 2024, linked HERE

Weekly Momentum Update Video (2:27)

Weekly Size and Style Update Video (4:13)

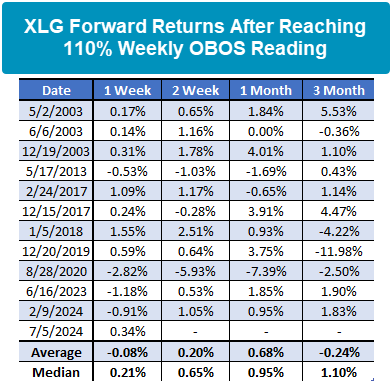

While the broad market stagnated in the second quarter, the mega caps continued to do well. The Invesco S&P 500 Top 50 ETF (XLG) gained 8.59% while the S&P 500 Equal Weight Index (SPXEWI) declined 3.09% in the second quarter. The strong performance by XLG has put it into heavily overbought territory with a weekly overbought/oversold reading of 117%. Going back to 2002, this is the 12th time XLG has reached the 110% overbought threshold. On average, returns are muted over the next three months while median returns are more positive. The average returns were driven down by a few occurrences, including January 2018, December 2019, and August 2020. In the context of today’s poor breadth, a slowdown in the mega caps could signal worse returns for the market. Overall, there isn’t much to suggest outsized returns in either direction when XLG becomes this overbought, but the main takeaway is that returns may level off over the next couple of months.