Recent Action in the Crypto Space is Leading to Some Notable Downside Developments

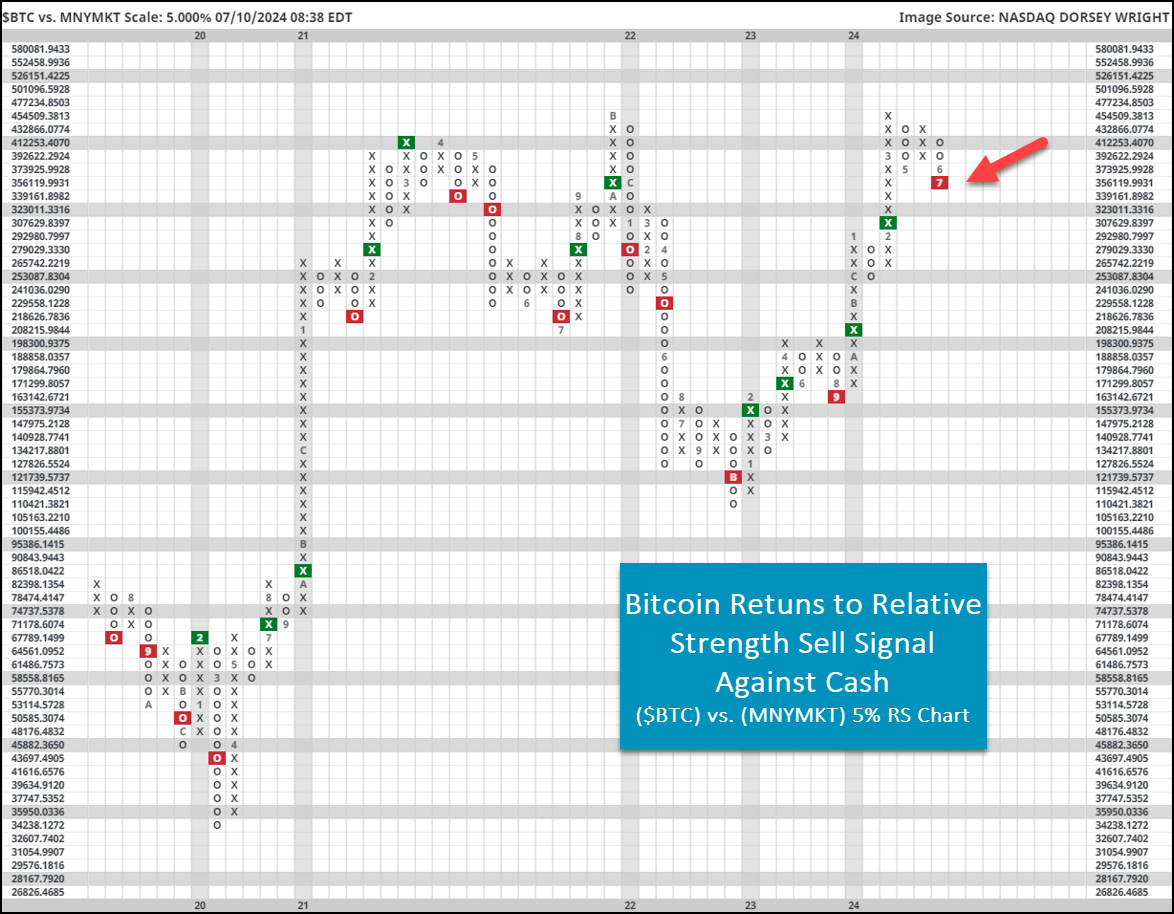

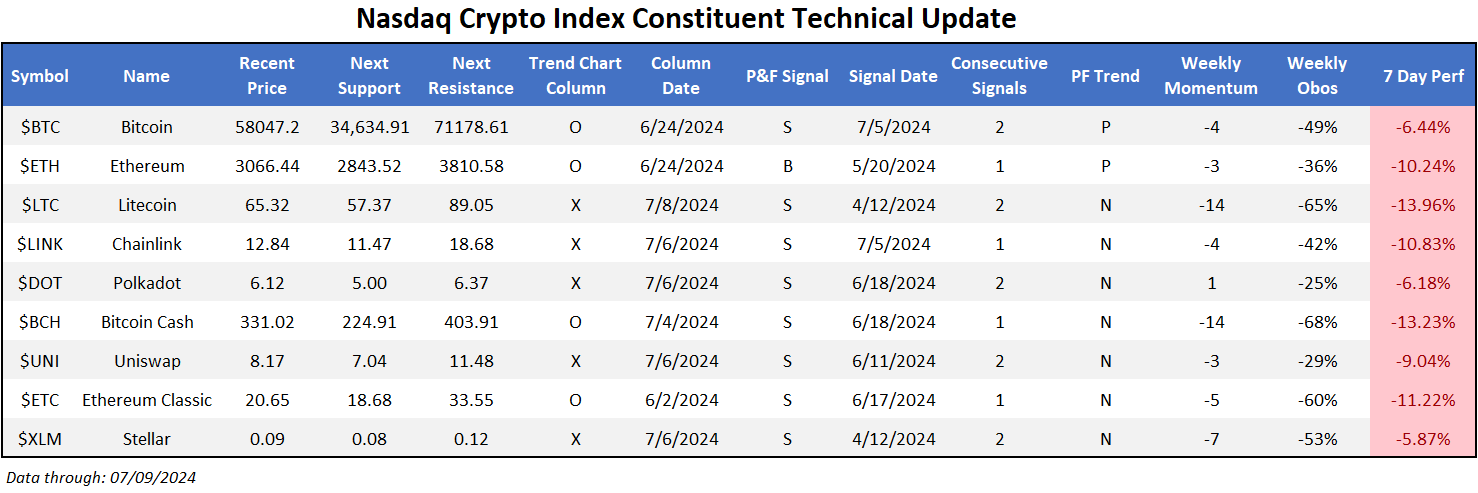

The broad crypto space finds itself in a bit of a tough position to open the back half of the year. Each coin within the Nasdaq Crypto Index (.NCI) moved lower over the last seven days, with some larger names falling as much as 15%. Previous reports have called for the need for extreme caution within the space as participation has been hard to come by- an idea present in today’s writeup as several coins break through more support on their default chart. Bitcoin moved back below what we have established as a key $60,000 mark for the second time in the last few months, posting a pair of consecutive sell signals for the first time since late 2022. While the last 24 hours have seen it rally back up towards that mark, the overall PnF picture is less than encouraging around current levels. Pair this with a recent return to a sell signal against cash proxy MNYMKT on a 5% relative strength chart, there is an argument to be had that Bitcoin has put in a top for now. The relative strength chart (pictured below) “tends to trend” with signals typically leading to more of that same type. While Bitcoin has certainly given headfakes before, price action today is presenting a picture increasingly difficult to defend.

While exposure to Bitcoin alone may not be an option for many investors, crypto-focused equities may be an option some have looked towards during the last year’s rally. COIN may have been an option due to its correlation with Bitcoin. While it is a 5/5’er, a quick look at a 5-point chart reveals what seems to be the bottom of a key range towards $200. If we do see continued deterioration for the crypto space, continue to watch relevant support levels for those equity positions you may have initiated as a crypto play during 2023’s rally. While a move past $200 may not lead to a fall into “unactionable” territory for the name from a technical attribute standpoint, it would act as confirmation that things are slowing down for the space.