Though most equity indices were negative for the week, the Invesco QQQ Trust (QQQ) and Invesco S&P 500 Top 50 ETF (XLG) bucked the fad.

Portfolio View - Major Market ETFs

| Symbol | Name | Price | Yield | PnF Trend | RS Signal | RS Col. | Fund Score | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|---|---|

| DIA | SPDR Dow Jones Industrial Average ETF Trust | 390.66 | 1.82 | Positive | Sell | X | 3.73 | 367.07 | + 2W |

| EEM | iShares MSCI Emerging Markets ETF | 42.90 | 2.58 | Positive | Sell | O | 3.30 | 39.62 | + 4W |

| EFA | iShares MSCI EAFE ETF | 80.39 | 2.91 | Positive | Sell | X | 4.05 | 74.05 | + 2W |

| FM | iShares Frontier and Select EM ETF | 28.34 | 3.44 | Positive | Sell | O | 3.42 | 26.81 | + 1W |

| IJH | iShares S&P MidCap 400 Index Fund | 59.02 | 1.37 | Positive | Buy | O | 4.59 | 54.26 | + 2W |

| IJR | iShares S&P SmallCap 600 Index Fund | 107.81 | 1.36 | Positive | Sell | O | 3.02 | 101.77 | + 2W |

| QQQ | Invesco QQQ Trust | 453.66 | 0.62 | Positive | Buy | X | 5.69 | 403.65 | + 2W |

| RSP | Invesco S&P 500 Equal Weight ETF | 164.85 | 1.59 | Positive | Sell | O | 3.05 | 154.01 | + 2W |

| SPY | SPDR S&P 500 ETF Trust | 525.96 | 1.34 | Positive | Sell | X | 4.30 | 474.16 | + 2W |

| XLG | Invesco S&P 500 Top 50 ETF | 43.17 | 0.88 | Positive | Buy | X | 5.71 | 38.13 | + 2W |

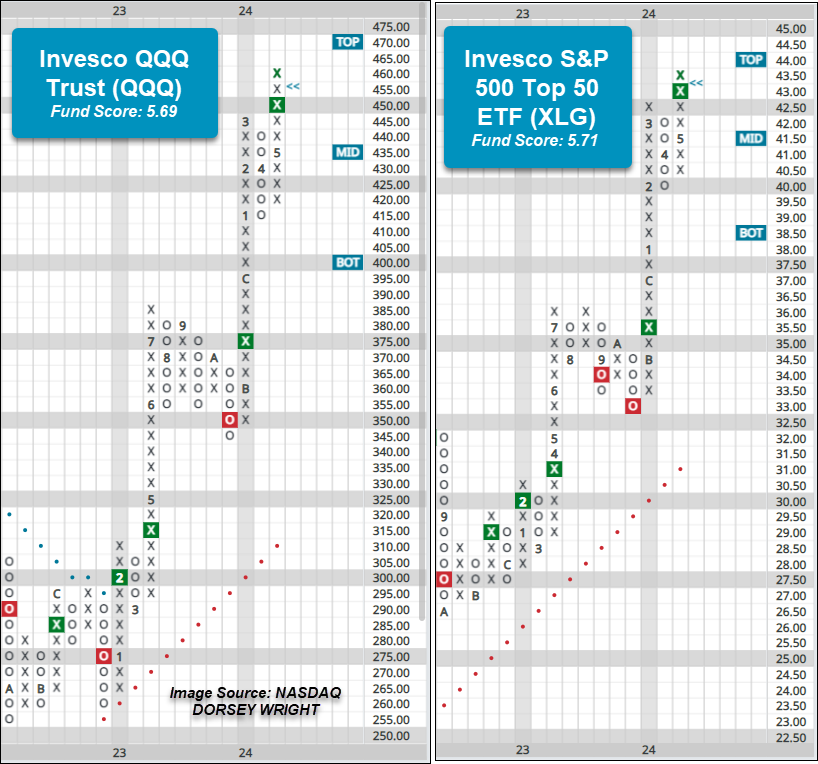

Though most equity indices were negative for the week, the Invesco QQQ Trust QQQ and Invesco S&P 500 Top 50 ETF XLG bucked the fad and were at least somewhat in the black through Thursday, up 42 and 12 basis points. These two funds were able to improve on their current chart position during Friday’s intraday action as each marked a new all-time chart high. This follows the funds – along with most equity indices – giving buy signals during last week’s trading. QQQ and XLG possess strong fund scores above 5 and positive score directions, highlighting the near-term improvement. Both ETFs reside in actionable territory, but are on the verge of moving into highly overbought territory. Those seeking to execute larger positions may look to add on a pullback, with reversals into Os potentially occurring with a move below $445 for the QQQs and below $42 for XLG. Support for the QQQs lies at $415 and $40 for XLG.

Additional Comments:

The past few weeks the Major Market piece has highlighted action within the international equity space, and this week another international fund deserves a shoutout for positive chart action. Following last Friday’s action the iShares Frontier and Select EM ETF FM reversed back into Xs at $28.50 on its default chart. FM possesses a fund score north of 3 and the fund has maintained a buy signal since July 2023. From here, a move above $29 would mark a third consecutive buy signal. Initial support lies at $27, while the bullish support line resides at $25.50.