Despite the positive week for the cryptocurrency space, there is some reason for pause/concern with technical developments over the last seven days.

Weekly Cryptocurrency Review (2:35)

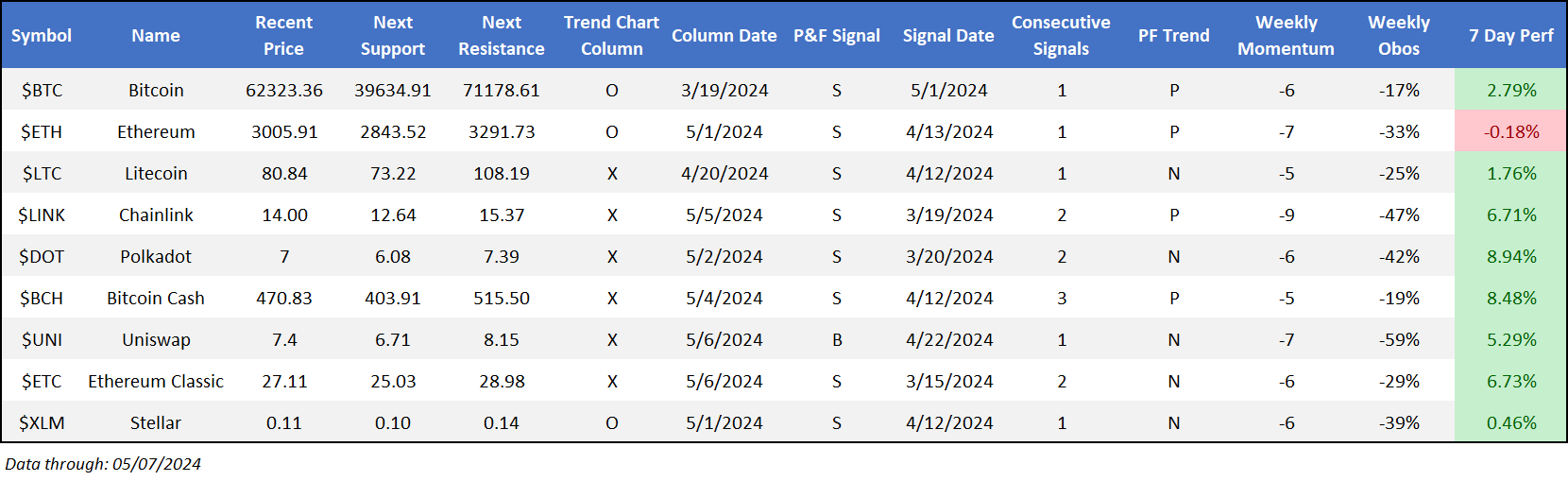

Despite the positive week for the cryptocurrency space, there is some reason for pause/concern with technical developments over the last seven days. Recent crypto-focused discussions have focused namely on what has emerged as a key downside mark around $60,000 for $BTC. Price action this week saw the coin violate this level, returning to a sell signal on its default chart for the first time since late 2022. This leaves it without support on its default chart until roughly $39,000 a far cry from current levels. While it would be aggressively bearish to suggest a straight shot to such support is in store, the violation of the $60,000 mark is notable nonetheless.

$ETH was the only coin within the Nasdaq Crypto Index (.NCI) to move lower over the last week. On its default chart, the coin has now put in a series of lower tops and sits on the verge of posting a second consecutive sell signal- which would be its longest streak since late 2022. Point being, while there certainly hasn’t been enough technical deterioration to say that the productive action so far this year is over, there is certainly an argument to be made that current holders should be cautious in the near term.