Visa (V) and Mastercard (MA) reached a $30 billion settlement to limit credit and debit card fees for merchants.

Chicago RS Institute: Register to join us in person for a 3-hour educational symposium on relative strength investing. This event is for financial advisors and will offer 3 hours of CFP/CIMA credit.

When: April 23, 2024, 8 AM CT - 11 AM CT

Where: 1 South Wacker Drive, Chicago, IL, 60606

Who: Speakers include...

John Lewis, CMT, Senior Portfolio Manager; Andy Hyer, CFP, CIMA, CMT, Client Portfolio Manager; Ian Saunders, Senior Research Analyst

Cost: Free! Breakfast will also be provided.

Registration is limited to the first 75 advisors, so be sure to act fast!

Today's Weekly Analyst Rundown video has been separated into shorter, individual videos, in addition to the long-form video that is still found at the beginning of this report. Each asset class will be included at the top of the corresponding featured article today, and each sector that saw notable movement will have a video recording included in the US Sector Update or the Were You Aware. The Fund Score update will be included in tomorrow's Fund Score Overview article. The sections of the video that do not have a corresponding article are included below:

Weekly Momentum Update Video (2:36)

Weekly Size & Style Update Video (1:31)

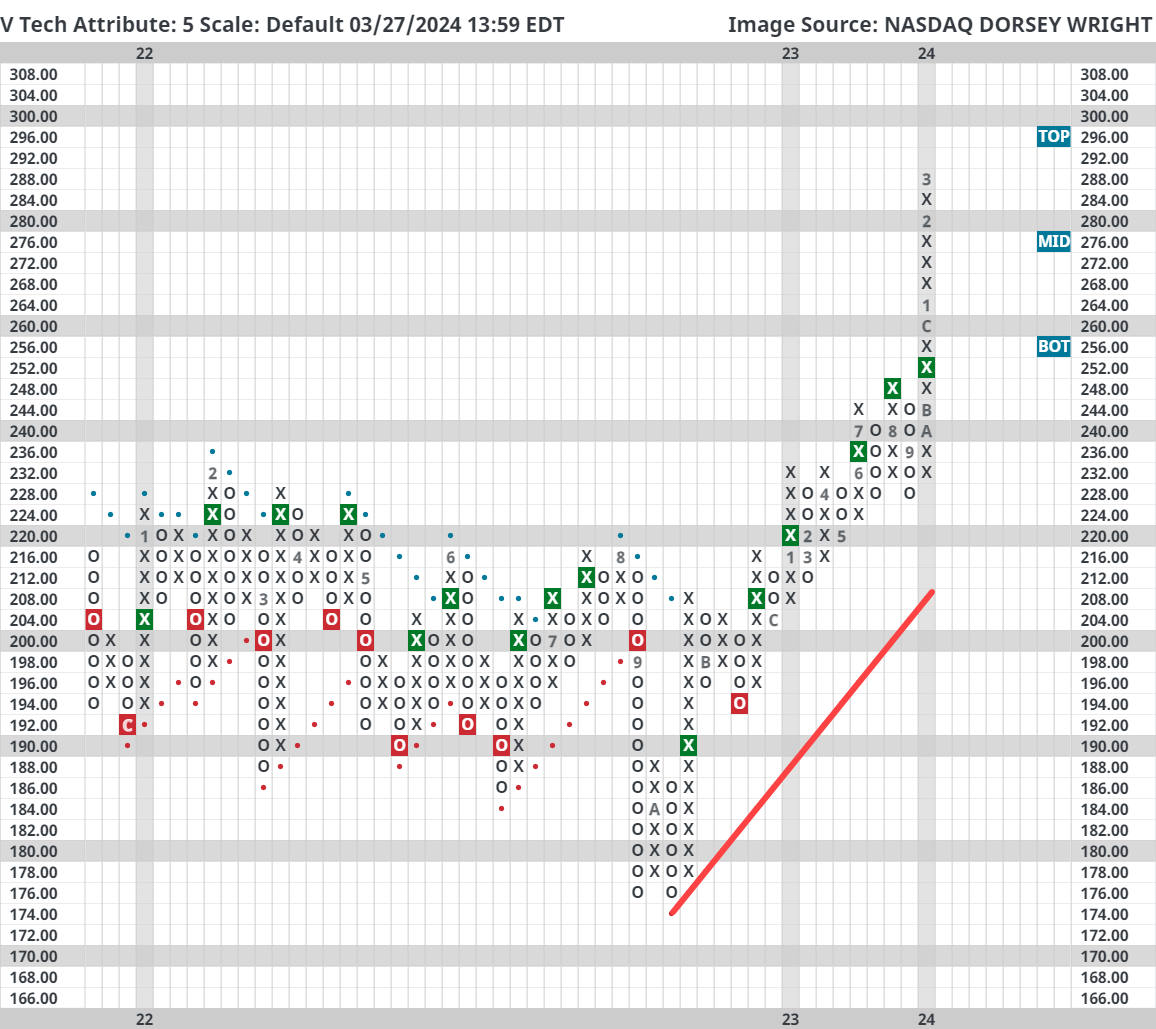

Visa (V) and Mastercard (MA) reached a $30 billion settlement to limit credit and debit card fees for merchants. The settlement still needs court approval but would resolve most claims in litigation that began in 2005. If the court approval goes through, then Visa and Mastercard would reduce their swipe rates by a few basis points and cap rates for five years. The lower swipe rates and pause in any increases will likely lower costs for businesses and potentially consumers (Reuters). The case doesn’t seem to have had much of an impact on MA and V as neither stock had any outsized moves on the news. V has been a perfect 5 for 5’er since October 2022 and MA has had at least four technical attributes since November 2022. The Financial Select Sector SPDR Fund (XLF) has V and MA as its third and fourth-largest holdings, respectively. V and MA make up more than 15% of XLF’s underlying exposure.