A Quick Review of Crypto Performance (Positive) and a Discussion of Miner Underperformance

Weekly Cryptocurrency Update (1:34)

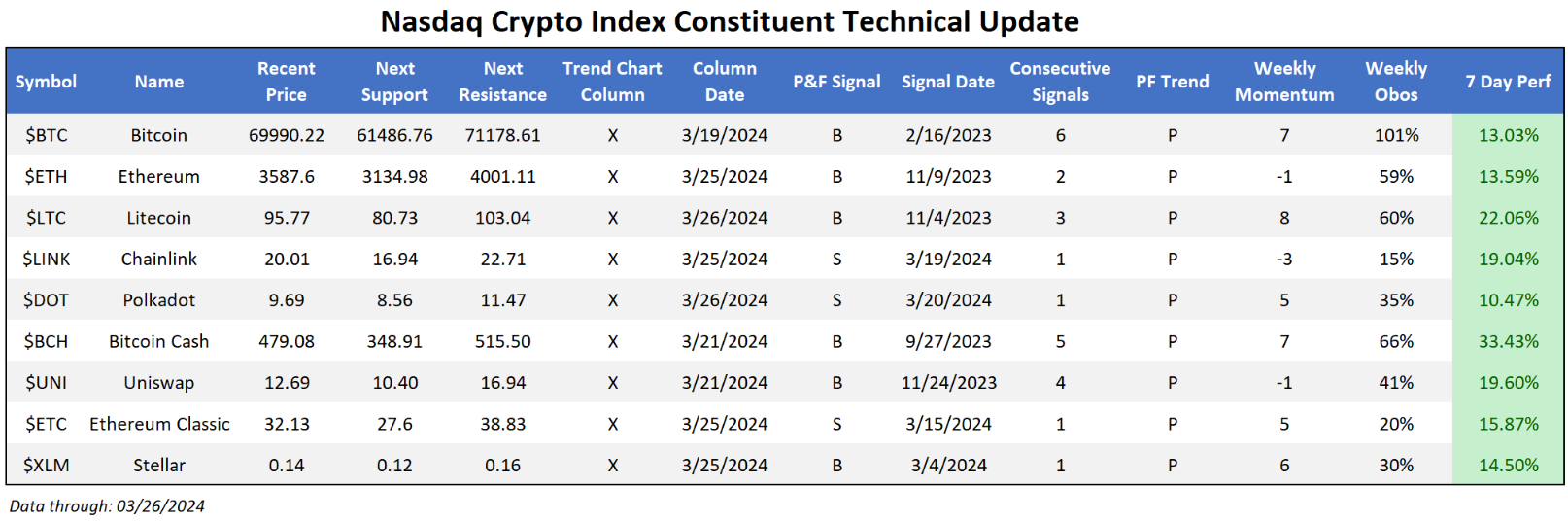

It was a positive week for the Nasdaq Crypto Index (NCI), seeing each constituent advance more than 13%. This coincided with many coins bouncing off relevant support (something mentioned last week as an important point to watch in the near-term) as all members now sit in columns of X’s on their default 5% chart. Perhaps more important for the long-term is the test (and subsequent rally) of $60,000 mark for crypto king Bitcoin. Bulls seem keen to defend this mark, establishing a bit of a range (roughly 17%-19%) between this near-term support and all-time highs above around $73,000. Regardless, bulls should consider this week’s action across the index as a sign of further confirmation of the space’s continued viability.

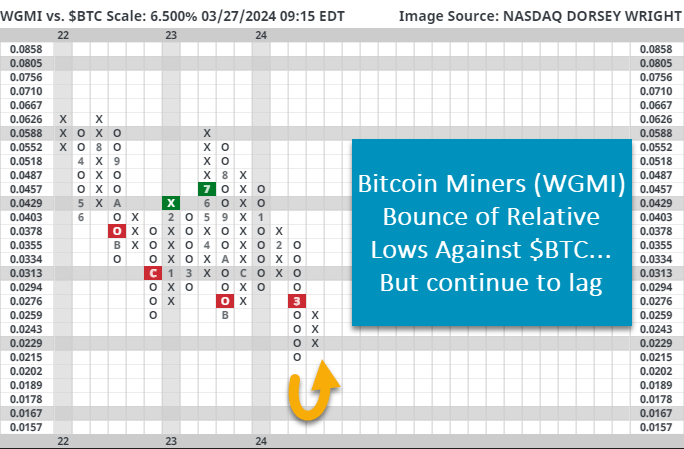

Today’s report will focus on the recent underperformance of Bitcoin Miners against Bitcoin itself. Looking at miners proxy WGMI, one can see a distinct YTD performance lag (1.22% for WGMI vs. 65.54% for Bitcoin) between the 2 names. While there are several possible reasons for the difference, perhaps the most fundamentally sound is the upcoming Bitcoin Halving. Rewards for mining additional Bitcoin will be cut in half, while the efforts, costs, and labor of mining will most likely stay the same. This compression of mining rewards could put continued pressure on the mining industry- despite interest in the sector being drummed up by the recently approved spot ETFs. From a technical standpoint, a simple Relative Strength (RS) relationship between WGMI & $BTC reveals the mining proxy bouncing off of relative lows against Bitcoin. This action coincides with the fund returning to a buy signal against SPXEWI, pushing its fund score higher. While positive, there is still plenty of work to be done before one would say relative strength within the crypto space sits with the miners. Both fundamental and technical question marks in play make simply buying $BTC a better option for now, but this near-term improvement for WGMI is something to watch as we approach the upcoming halving.