The broad crypto space book a brief step back for the last seven days.

The broad crypto space took a brief step back for the last seven days. The stumble is what the analyst team would consider to be “healthy” for now. Even for the volatile crypto world, near-term indicators (weekly OBOS and weekly Momentum readings) were getting stretched following several consecutive weeks of large moves toward the upside. Fundamental catalysts remain largely the same, namely a focus on the eventual approval of a spot Bitcoin ETF and the Bitcoin Halving that is slated for the first half of 2024.

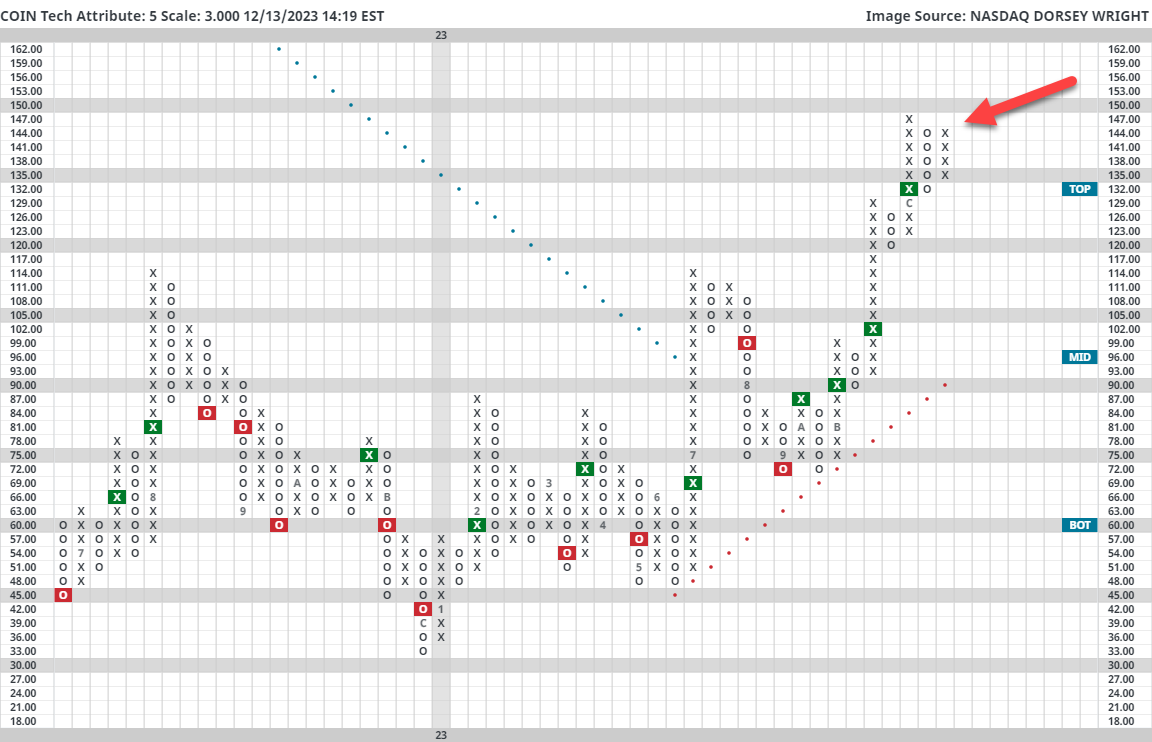

While individual coins are not appropriate for many, there may be several clients interested in putting some Christmas money to work within the space as it has been roaring recently. While considering the suitability of crypto in a client's portfolio is always the first priority, those interested in looking for exposure do have a number of options they could look towards. First, the ProShares Bitcoin Strategy ETF (BITO) has put together a productive year so far, holding a near-perfect 5.98 fund score and advancing nearly 100% this year. While there is some merit to the idea that the approval of a spot Bitcoin could have an impact on the fund as buyers rotate towards a possible new product, BITO is a technically strong idea for the time being. If equities are more your speed, COIN could be considered. This perfect 5/5’er sits on a string of buy signals on its 3-point chart and recently put in newly established support at $132. While it does move around more than other equity names, it could be considered as a dollar-cost-averaging candidate as we move to the new year.