It was yet another productive week for the broad crypto space, seeing the Nasdaq Crypto Index advance 9.81%, outpacing the S&P 500 by over 7%

It was yet another productive week for the broad crypto space, seeing the Nasdaq Crypto Index (NCI) advance 9.81%, outpacing the S&P 500 (SPX) by over 7%. This outperformance came off the back of yet another dominant week for crypto heavyweight Bitcoin, which gained just under 15% over the last 17 days. This positive action led to a variety of constructive technical developments on the default 5% Point and Figure chart, seeing the crypto king break back into a positive trend for the first time since early April 2022 and breaking past key resistance dating back to last summer in the process. While the move does bring Bitcoin into what would typically be considered heavily overbought territory for other securities, the nature of this space dictates that elevated weekly OBOS readings are not uncommon. With Bitcoin re-entering a positive trend, consider moving to a more broad exposure strategy within the space as 2023’s stellar performance seems to be having overarching positive effects on the industry.

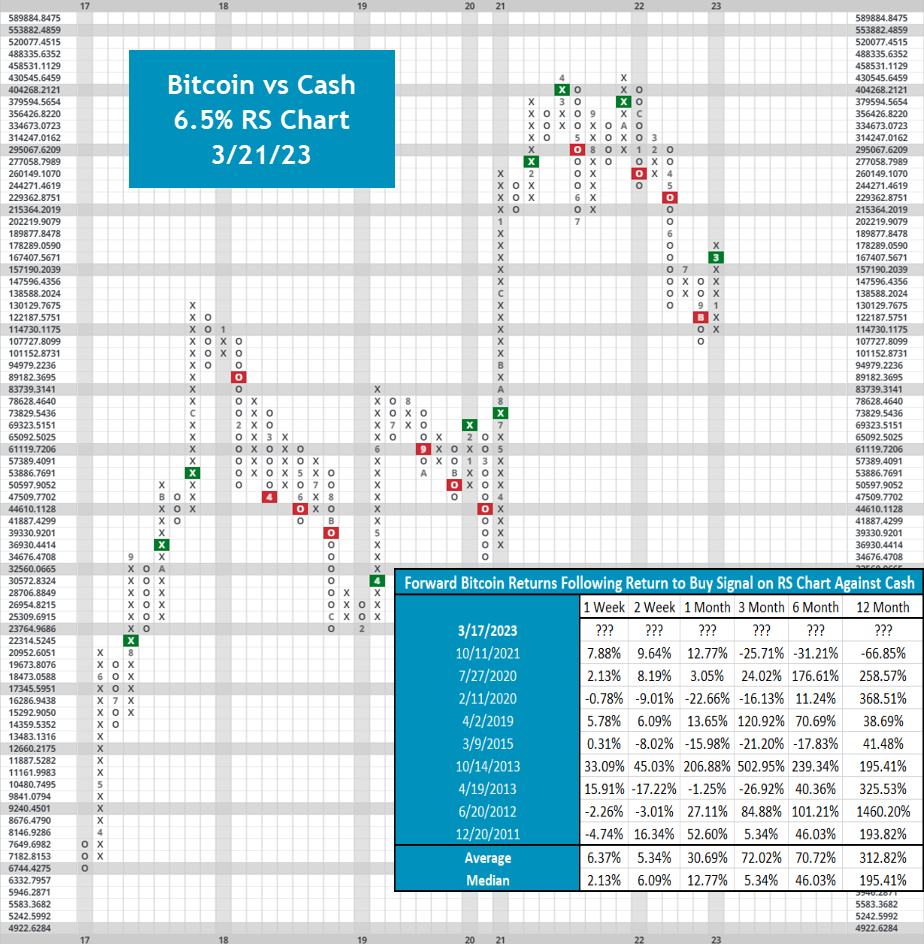

Another positive sign for Bitcoin comes from its 6.5% Relative Strength (RS) chart against cash. This week, Bitcoin returned to a buy signal against cash for the first time since late 2021. 2022’s poor performance led $BTC to post a series of three consecutive RS sell signals against cash, signaling long-term weakness against the money market. However, historical forward returns following a return to a buy signal against cash are strong, showing a near 90% positive hit rate 12 months out. While average returns are inflated by a stellar few years, median returns still highlight the strength of following this signal. While a few other standout crypto names (namely Litecoin $LTC & Ethereum $ETH) returned to buy signals throughout the last few months, Bitcoin’s RS chart has been closely watched for signs of broad strength. While the recency bias of 2021’s head fake certainly serves as a harsh reminder of the volatility of the space, it certainly seems as if this RS buy signal is a positive sign.