Over 1300 stocks in the Nasdaq Composite Index printed a new 52-week low Friday, which is among the highest daily counts in our historical data. AAII sentiment results also showed one of the lowest bullish sentiment readings we have seen.

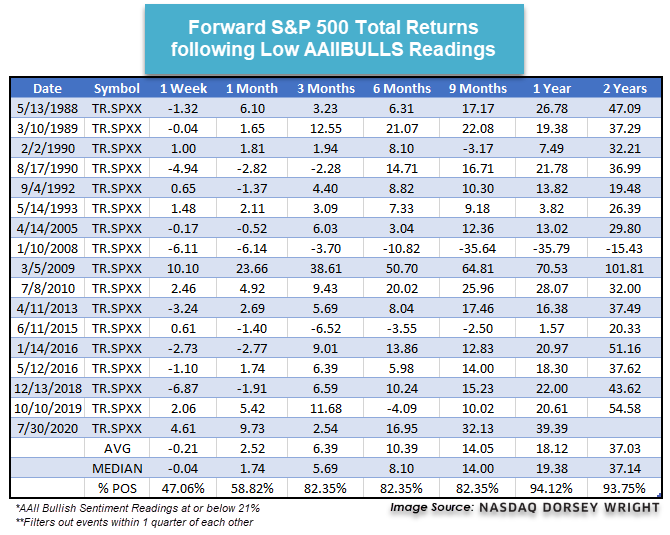

The latest AAII Sentiment Survey saw just 20.96% of members indicate they were bullish on the direction of the stock market over the next six months. This is one of the lowest weekly readings we have seen for the AAII Bull Sentiment Survey AAIIBULLS, with just 17 other unique instances since 1987 that have posted lower readings. Forward returns from those prior occasions show heightened potential for weak returns over the following week, however, the average returns are generally strong as you move one month or more away from the low readings. Moving one month out the total return of the S&P 500 TR.SPXX is positive about 59% of the time, which increases to an 82% positive rate three months out from the sentiment low.

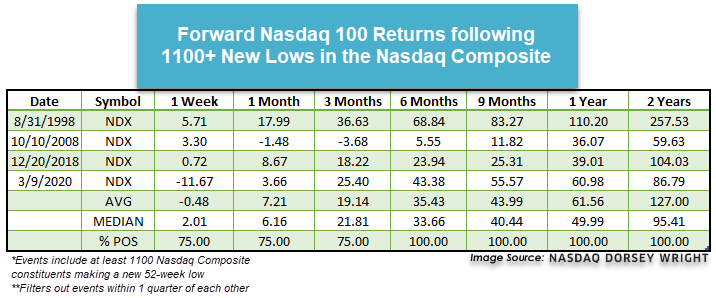

Market action on Friday saw over 1315 stocks in the Nasdaq Composite NASD print a new 52-week low, which equates to over a third of the index constituents. There have only been four other occasions that have seen at least 1100 new lows, which all came in the midst of extreme market turbulence. When looking at the forward returns for the Nasdaq 100 Index NDX from each of these instances, we see a similar story to the low sentiment readings above, although these returns are more pronounced. Returns are generally muted or negative for the week following the multitude of new lows, however, those returns improve significantly one month after each date in three out of the four periods, with the exception being October 2008.