A technical update on companies with direct or indirect exposure toward bitcoin.

It has been hard to ignore the meteoric price appreciation of Bitcoin $BTC over the first several weeks of 2021. As we covered in last Wednesday’s report, the largest cryptocurrency by market cap crossed above $50,000 for the first time before pushing to a new record high north of $58,000 this past weekend. Although Bitcoin pulled back intraday Monday, it still has a market capitalization of more than $980 billion at the time of this writing. If bitcoin were a company, it would be the fifth-largest by market capitalization in the U.S., sitting ahead of companies such as Facebook FB and J.P. Morgan Chase & Co. JPM. Of course, bitcoin is not a publicly-traded company, and it certainly has its fair share of critics across the investment community. This has made it difficult for advisors to gain direct exposure in the leading crypto asset. However, individual companies are increasingly recognizing bitcoin as a legitimate alternative to traditional reserves, with Tesla TSLA being the most famous recent adopter after stating they invested $1.5 billion into bitcoin and will allow customers to purchase vehicles with the cryptocurrency. Other companies have aided the legitimacy of cryptocurrency without direct investment. One such company is Mastercard MA, which announced earlier this month that they would soon support crypto transactions by allowing individuals to convert cryptocurrency into traditional currency for purchasing goods (source: cnn.com). With the growing number of companies jumping on the bitcoin bandwagon, we wanted to provide a technical update on US companies with bitcoin reserves, as well as those companies looking to streamline transactions in cryptocurrencies.

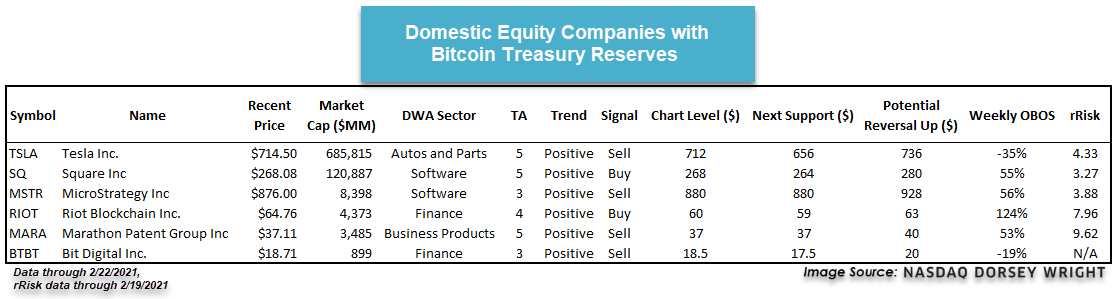

According to bitcointreasuryreserve.com, there are now 19 public companies trading across global markets that have some exposure to bitcoin through their treasury reserves. Today, we are going to focus on the six domestic representatives that are found on the NDW research platform. Through trading on Friday (2/19), each of the six stocks possessed a technical attribute rating of 3 or better, and they averaged a year-to-date gain of 136%. The pullback in bitcoin and broader equity markets Monday led each name to continue lower in a column of X's, however, many of these stocks were retracting from overbought territory, potentially allowing more opportune entry points for those looking to gain exposure. It is worth keeping in mind that many of these companies see enhanced levels of volatility, as shown through the heightened relative-risk (rRisk) readings. We have provided some technical information on each name below, along with near-term support and the chart level needed for a potential reversal higher from current levels.

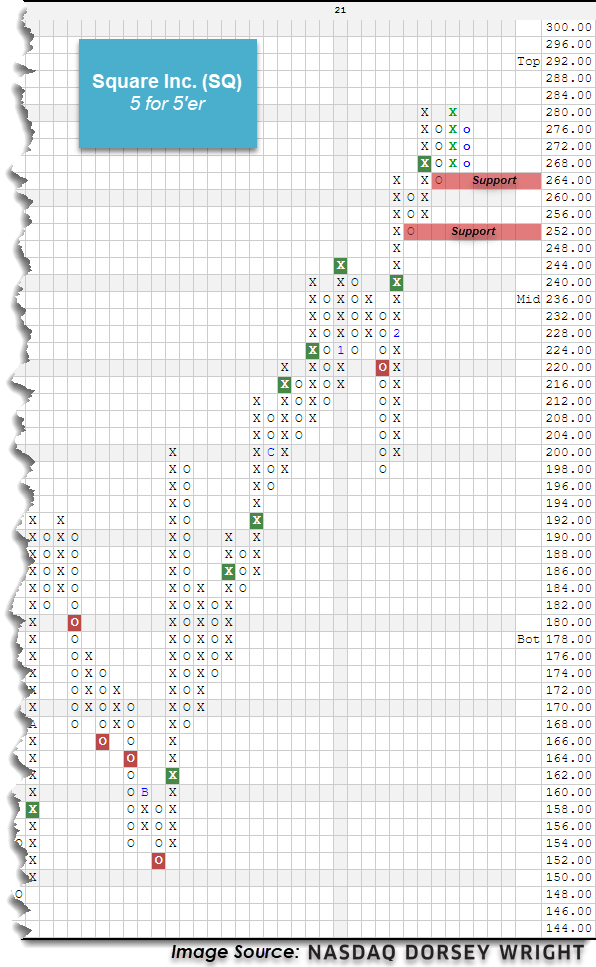

Out of the names included above Square SQ presents one of the more favorable technical pictures. This company announced in October of last year that they were investing in 4,709 bitcoins, which has grown from an initial investment of $50 million to over $250 million at the time of this writing. The stock has moved considerably higher over the last few weeks, with SQ rising to give two consecutive buy signals before forming another double top Friday at $280. This 5 for 5’er also ranks in the top quartile of the favored software sector RS matrix. Movement on Monday led SQ to pullback into a column of Os to $268, which also led to a normalization of the trading band with an intraday weekly overbought/oversold (OBOS) reading of about 62%. Those looking to add exposure may consider the stock at current levels. Initial support can be found at $264 with further support offered at $252.

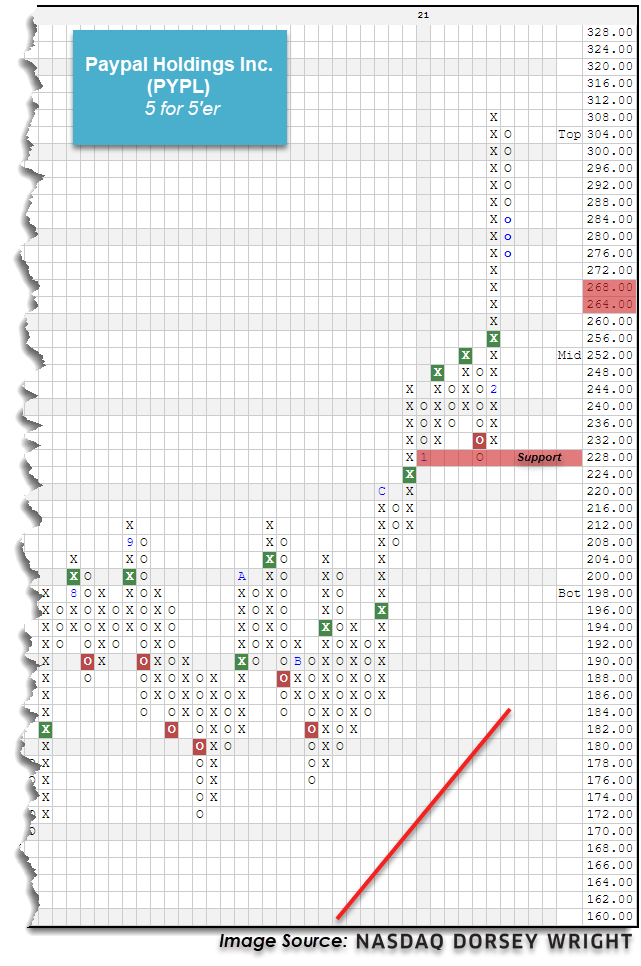

While we have seen several companies partially transition their reserves to bitcoin in the past few months, the adoption across the broader financial and banking institutions has not seen as much traction. As we mentioned earlier, MasterCard is the latest such company to announce its intent to allow transactions in bitcoin at some point in 2021. Another fintech company that has become involved in cryptocurrencies is PayPal PYPL, which is giving users the ability to buy and sell select cryptocurrencies on its platform and will also be allowing merchants to accept bitcoin as payment in the near future (source: PayPal). PYPL moved considerably higher earlier this month, as it gave a buy signal at $256 before continuing to a new all-time high at $308. The stock has since pulled back from overbought territory to a current chart level of $276 intraday Monday while maintaining a 5 out of 5 technical attribute rating. Exposure may be considered at current levels for more aggressive individuals, or upon further pullback/normalization of the trading band. Initial support is not offered on the default chart until $228, while the potential for further near-term support may be seen on the more sensitive 2-point chart at $264.