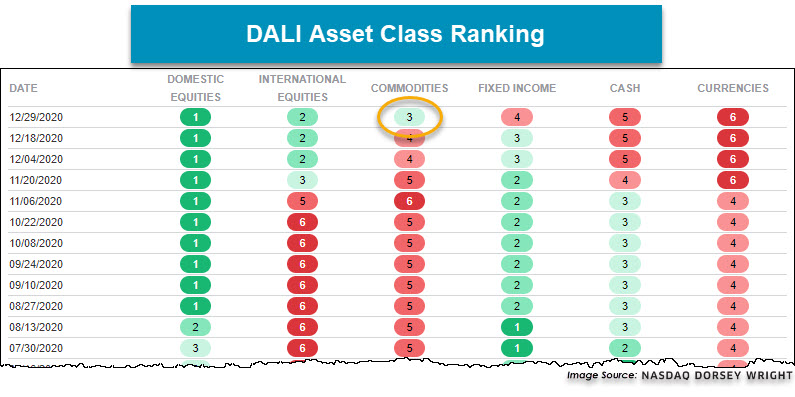

2020 has brought about quite a bit of change, and as we wind down the year we have seen one more change as it relates to the DALI asset class ranking with Commodities moving up into the third position. Commodities overtook Fixed Income to move into third place behind US Equity (which is still number one) and International Equity (number 2). The last time Commodities were ranked this high was April 2019, and this move has been largely driven by the strength in Crude Oil CL/ as well as Base Metals. Crude Oil is up more than 20% over the past three months while the Invesco Base Metals ETF DBB, which holds position in copper, zinc, and aluminum, is up more than 14%. So, commodities, in general, are a place that you may consider adding some exposure to as we head into the New Year with a focus towards Energy and/or Industrial Metals.

For those that are looking for ways to gain exposure to commodities you may also consider the Invesco Commodity Model POWRSHARES, which designed to hold two of the strongest ETFs out of an inventory of eight Invesco Commodity ETFs. Year-to-date the model is up over 40%, compared to -7% for the S&P GSCI Commodity Index, and the Model currently holds the Invesco DB Oil ETF DBO and the Invesco DB Base Metals ETF DBB.