The improvement in the Small Cap space has been seen on a number of different fronts, DALI included, as the 3 Small Cap related style boxes are the 3 most improved style boxes within DALI

Equity markets were generally flat over the course of the past week with the S&P 500 SPX down 0.21% and the S&P 500 Equal Weighted Index SPXEWI down just 0.06% (12/8 – 12/15); however, Small Caps remained a bright spot. The iShares Russell 2000 ETF IWM is up more than 25% over the past 90 days compared to a 9% gain for the S&P 500. Interestingly enough, all segments of Small Caps have seen gains in excess of 25% over the past three months including Small Growth and Small Value.

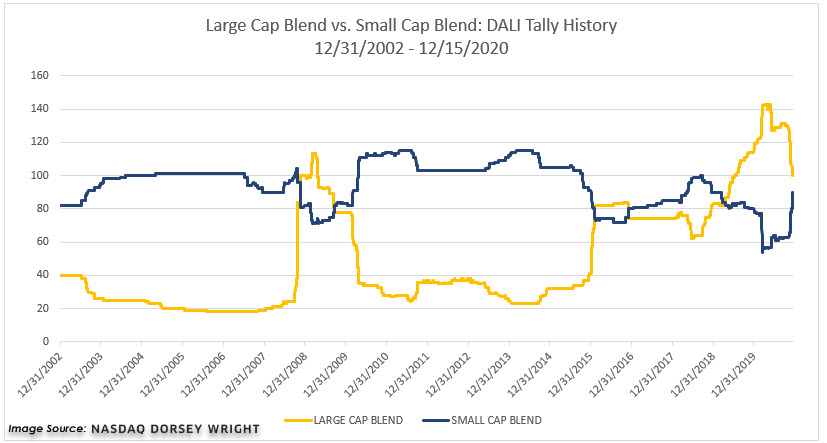

The improvement in the Small Cap space has been seen on a number of different fronts, DALI included, as the 3 Small Cap related style boxes are the 3 most improved style boxes within DALI, with Small Cap Growth continuing to be the strongest. While Small Cap Growth has been in the top three styles for much of this year, Small Blend and Value are moving up the ranks to the extent that Small Blend is close to overtaking Large Blend, which would be the first time in nearly two years Small Blend would be ahead of Large Blend. All this is to say, we are continuing to see improvement in the Small Cap space as we head into the end of 2021.