Momentum Seasonality

Momentum Seasonality

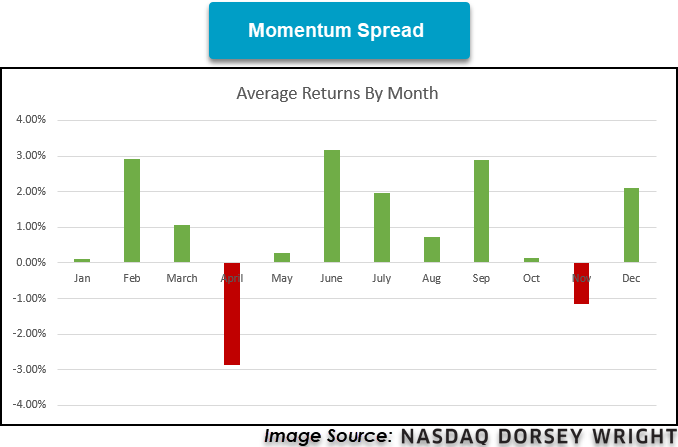

December has historically been very strong for momentum, but November has been more of a mixed bag. Below are the average monthly returns of the momentum spread (Leaders minus Laggards):

Momentum Spread

There are two outlier Novembers in 2001 (-14.9%) and 2002 (-25.8%) that skew the monthly average lower. Excluding those two months, the spread has a similar return in November to the return on January and October.

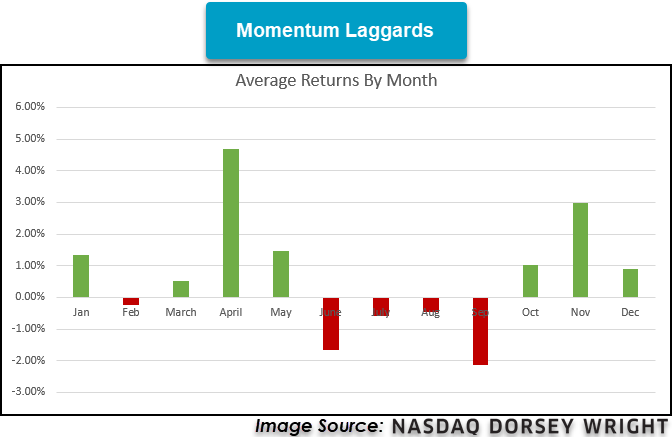

The low spread numbers are primarily driven by the returns of the laggard stocks. November is the second month for laggard stock returns. The same years (2001 and 2002) were particularly strong for the laggard names.

Momentum Laggards

Looking at high momentum stocks, November has actually been near the average of the other months.

Momentum Leaders

November has been a mixed back for the leader vs. laggard relationship. High momentum has generally performed well, but there have been a few bouts of large laggard outperformance. With the election occurring this year, we may have a volatile month for momentum, but that is not something that will happen for sure. Given that December has historically been the best month for momentum, it is prudent to take a wait-and-see attitude rather than proactively shedding high momentum names right before the historically strongest month of the year.