The pandemic continues to unexpectedly shift supply and demand curves, the latest observation coming from the pet care industry

Wells Fargo Advisors: You can find a CAR approved version of last Thursday’s quarterly newsletter under the "Other" section of the "Media & Education" page. The CAR ref number is CAR-1020-01326.

Beginners Series Webinar: Join us on Friday, October 16th, at 2 PM (ET) for our NDW Beginners Series Webinar. This week's topic is Navigating the Dynamic Asset Level Investing (DALI) & Asset Class Group Scores (ACGS) pages. Register here.

The pandemic continues to unexpectedly shift supply and demand curves, the latest observation coming from the pet care industry. With individuals being encouraged to spend greater amounts of time at home, pet ownership has climbed, along with demand for related services offered by animal-health companies (Source: wsj.com). Take for example a name like Freshpet FRPT, an American business that manufactures refrigerated food and treats for animals, their stock is up over 100% this year (through 10/14). Another example is a company called IDEXX Laboratories IDXX that develops, manufactures, and distributes products to the animal veterinary markets, their stock is up over 60% this year. Both of these names returned to strong attribute territory (technical attribute of 3+) in the middle of March and have not looked back.

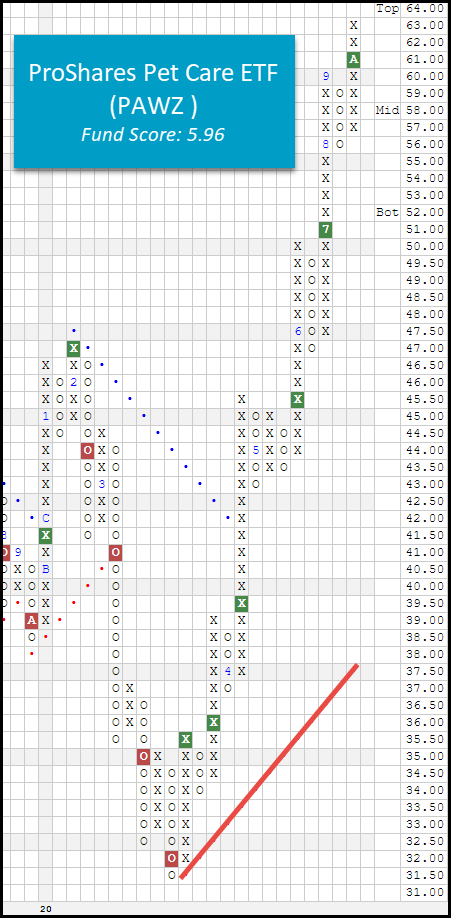

FRPT and IDXX are the two largest holdings in the ProShares Pet Care ETF PAWZ, a strategy that stands to benefit from people’s passions for their pets (Source: proshares.com). PAWZ hit a fresh all-time high today (10/15) and carries a stellar 5.96 fund score atop a positive score direction of 0.97, adding technical merit to its thematic strength. Despite the favorable picture, PAWZ is pushing into extended territory so those looking to initiate new long exposure may consider dollar-cost averaging in or entering on a contraction. Initial support is offered at $56.