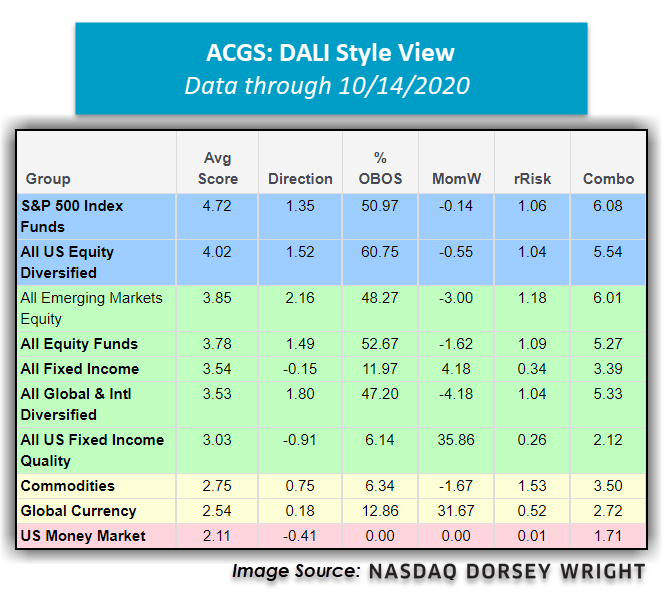

The DALI Style view of the Asset Class Group Scores (ACGS) page depicts only those major market areas that are meant to represent the broad investible asset classes globally. The S&P 500 Index Funds group has remained in the top position in these rankings over the past several weeks, with its recent score posting of 4.72 placing it in 10th out of all 135+ groups tracked on the ACGS system. US Money Market, the cash representative in this breakdown, still ranks lower than any other of the DALI Style groups at a position of 125 among all groups with an average score of 2.11. Commodities and Global Currency make up the other groups south of the favorable 3.00 score threshold, as the remaining equity and fixed income-related groups are all found in the “green” or “blue” zone.

One group that has shown recent strength is the All Emerging Markets Equity group, which currently is positioned just south of the 4.00 threshold with an average score of 3.85. This group also possesses the highest average score direction of any of the DALI Style groups, with a recent directional posting of 2.16.

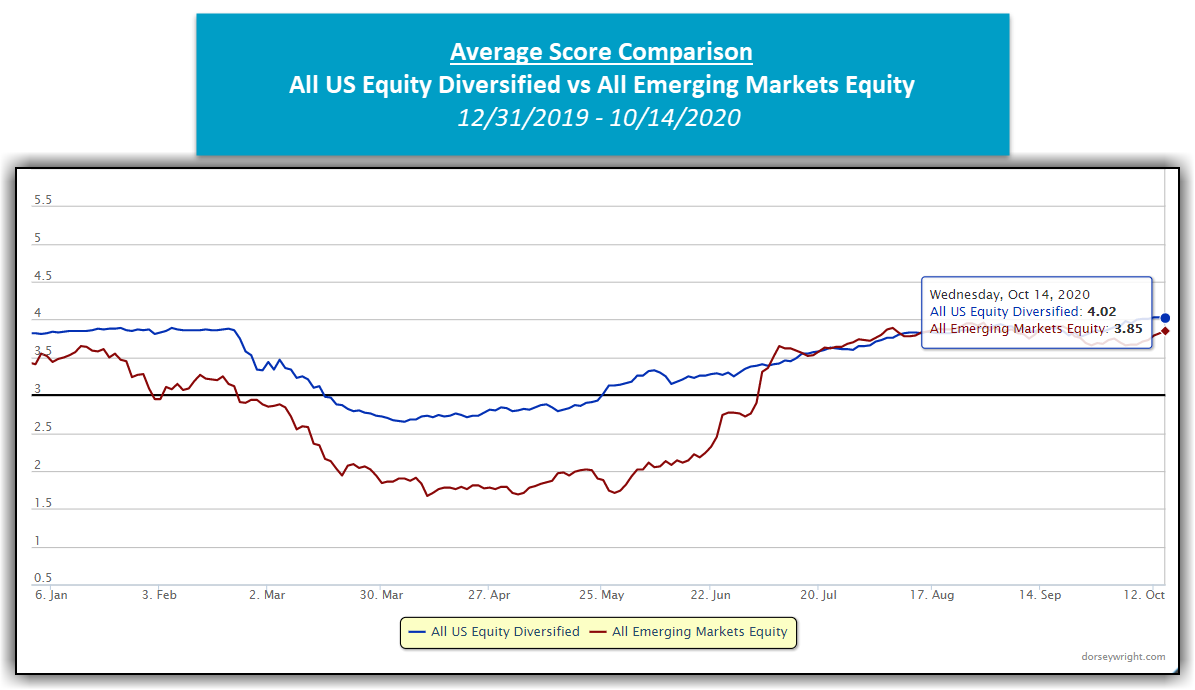

The emerging markets equity space had been positioned in line with the all US Equity Diversified group throughout much of the global equity rally, however, the volatility that ensued in September led to a weakening score from the emerging markets representative. After being positioned above all US Equity Diversified in mid-September with an average score of 3.91, Emerging Markets Diversified fell slightly south but has shown recent improvement to bring the group back to relatively the same position. The All US Equity Diversified group has continued to move steadily higher, but the domestic representative has not advanced as quickly as the emerging markets group in recent weeks. This relationship will be important to monitor as we head through the final months of 2020.