The European Union came to an agreement on a new spending package earlier this week, which sent shares of several individual country representatives higher.

Global economic uncertainty stemming from the COVID-19 fallout has continued, as countries search for the best way to kick start their economies with an increasing number of employees readily available to return to work. This is not just a problem for the U.S., as many foreign governments work through stimulus options to increase their economic activity. Earlier this week, the European Union (EU) announced their latest spending plan, which included over $2 trillion in fresh stimulus for the member countries (source: wsj.com).

This came as positive news for many investors in the region, leading to rallies in European equities as shown through the iShares MSCI Eurozone ETF EZU, which moved higher to give its fifth consecutive buy signal at $39 after the announcement was made Tuesday. EZU had already seen a substantial rally off its March low of $25.50, allowing for a technically sound recent fund score posting of 3.55 following the recent news. Some areas within the EU have held up much better than others, however, with a specific focus on the Netherlands, Germany, and Sweden, each of which has representatives ranking in the top half of our World ETF Premade Matrix that also has favorable recent fund scores.

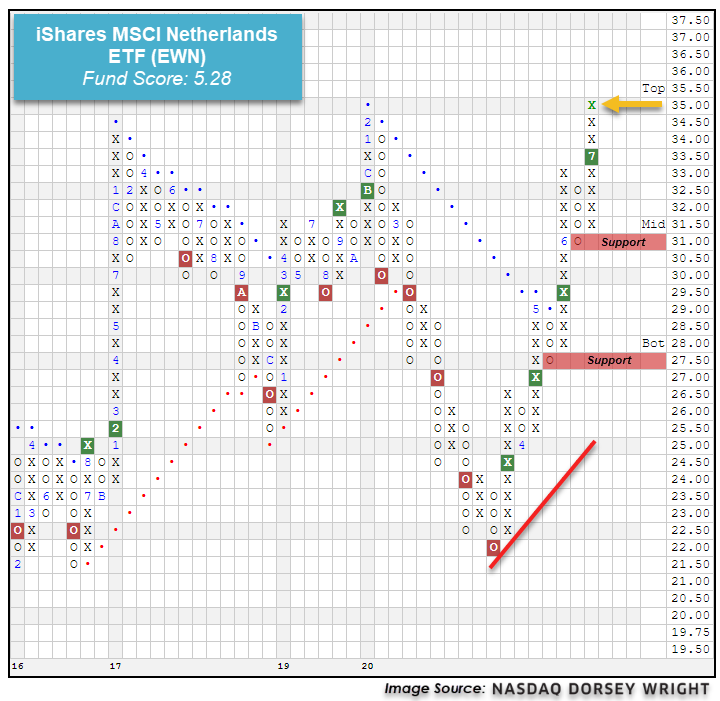

The iShares MSCI Netherlands ETF EWN has shown continued strength since reversing up from a multi-year low of $22 in March, giving four consecutive buy signals while also moving back to a positive trend in May. The stimulus news earlier this week led to a further increase in demand for the fund, as EWN moved to a new all-time high in trading Tuesday at $35. This continued improvement for the Netherlands representative has led the fund to rank 3rd out of the 48 country or region-specific funds found in the World ETF Matrix, demonstrating its strength among global equities. The recent 5.28 fund score posting for EWN bests the average European fund of 2.70 as well as the average non-US equity fund of 3.08 and is paired with a strongly positive 4.64 score direction, indicative of its recent price rally. Weekly and monthly momentum each recently flipped positive, suggesting the potential for further price appreciation from here. Those looking to add exposure should note that EWN is in overbought territory after the recent price movement, with initial support found at $31.

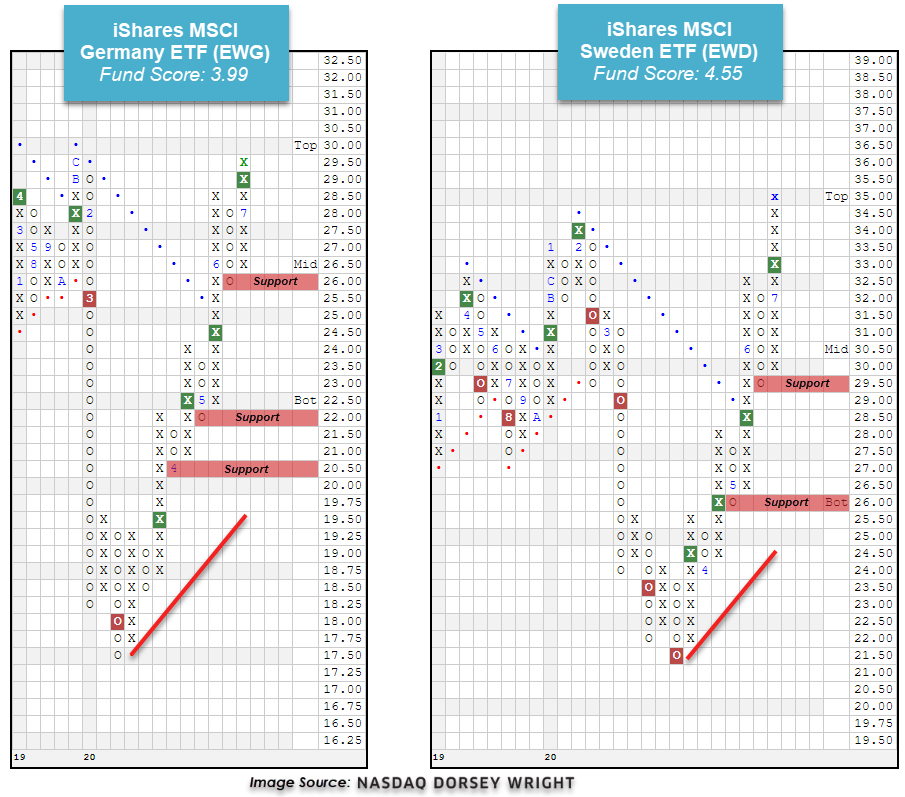

The iShares MSCI Germany ETF EWG and the iShares MSCI Sweden ETF EWD have each also led the EU member countries from a relative strength perspective, coming in at respective rankings of 14th and 16th in the World ETF Matrix. These areas have each moved higher to be at or near new 52-week highs after the stimulus announcement earlier this week, and have also each given four consecutive buy signals since their March lows. Germany (EWG) carries a favorable fund score of 3.99, while Sweden (EWD) shows a slightly better score of 4.55, each of which is paired with a score direction exceeding 3.00. In a similar fashion to the EWN, the continued price improvement from these funds has led to overbought/oversold (OBOS) readings north of our 70% threshold, indicating that new exposure would be best considered following a pullback or normalization of their respective trading bands.