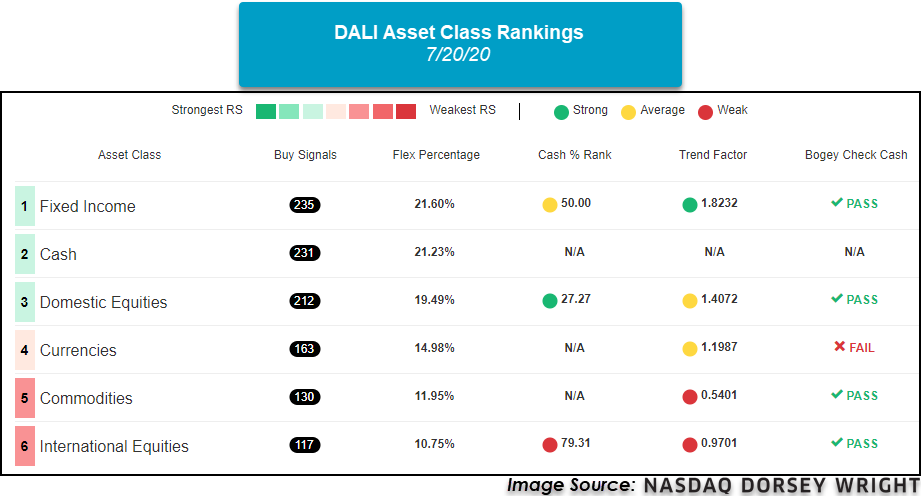

Fixed income overtakes cash as the number one ranked asset class within DALI.

Market Update Webinar Replay: Missed Monday's webcast? Click the link(s) below for a recap:

Mid -Year Market Review: Join the Nasdaq Dorsey Wright team on Wednesday, July 29th at 1pm EST as we discuss the volatile market movement through the first six months of the year and what to monitor in the second half of 2020. Click here to register.

Speakers include:

- Jay Gragnani, Head of Research and Client Engagement

- John Lewis, CMT, Senior Portfolio Manager

- Jamie West, CFA, Senior Analyst

- Chuck Fuller, Senior Vice President, Applied Research

Models Workshop: The Investment Models Workshop is designed specifically for financial professionals looking to incorporate Nasdaq Dorsey Wright's (NDW) turnkey model solutions into their investment practice, as well as those who would just like to learn more. This three-hour virtual course will not only give you the chance to engage with experts from NDW, but will also expose you to new strategies, investment frameworks, and best practices for utilizing the NDW Research Platform to help you manage your business with more confidence, efficiency, and greater scale. Investments & Wealth Institute® has accepted the Nasdaq Dorsey Wright Investment Models Workshop for 3 hours of CE credit towards the CIMA®, CPWA®, CIMC®, and RMA certifications. The workshop will take place August 6th, Click here for more information.

After yesterday’s market action, fixed income moved ahead of cash in our DALI rankings. Fixed income now possesses 235 buy signals compared to cash which has 231 buy signals. As a reminder, there is a buffer of five signals before some DALI strategies change, like the 3-Legged Stool strategy. Looking closer at fixed income in DALI, US preferreds & convertibles are the top sub-asset class which can be attributed to the recent run-up in equities since the COVID-19 sell-off. For those wishing to be updated on asset class changes within DALI moving forward, be sure to set alerts. You can do this on the DALI overview page by clicking on the “Set Alerts” button found in the top right of the page. From there, toggle on the “Alert for a change in the Asset Class Rank” option to receive an email when a change occurs.