The technical stars aligned for Dow, Inc. (DOW) and DuPont de Nemours Inc. (DD), as each entered strong attribute territory earlier this week for the first time.

Market Update Webinar Rescheduled - Due to the Memorial Day holiday, next week's Market Update webinar has been rescheduled for Tuesday, May 26 at 1:00 p.m. ET. Those who have already signed up will remain registered. If you haven't already registered but would like to, click here. Reminder that the webinar will be recorded and made available to all registrants who are existing subscribers following the live presentation.

Replay of Monday's Market Update Webinar - We now have the replay available from our Monday, May 18th market update webinar. Links to the video and presentation slides are provided below.

Click here to access the replay

Click here to access the slides

Beginners Series Webinar - Join us on Friday, May 22nd at 2 PM (ET) for our NDW Beginners Series Webinar. This week's topic is Understanding the Asset Class Group Scores Page. Register here.

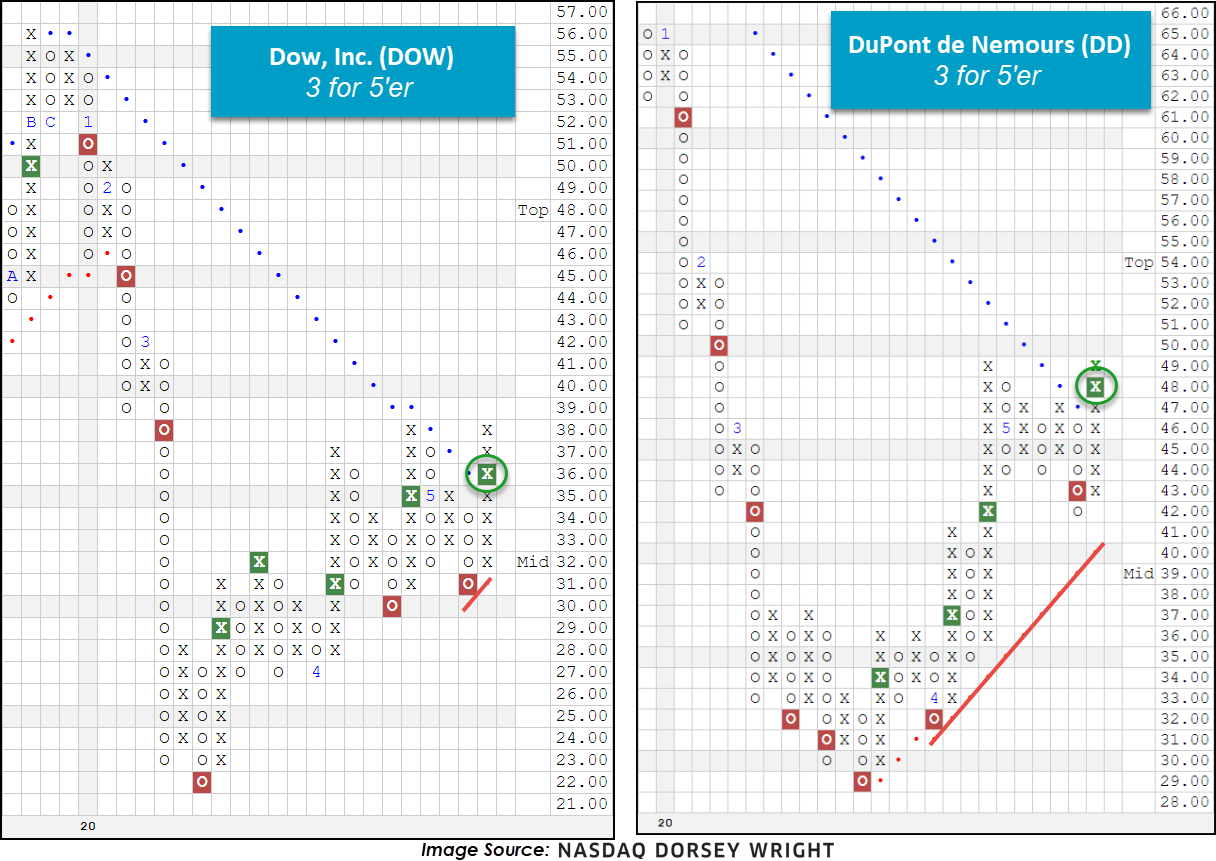

The technical stars have aligned for Dow, Inc. DOW and DuPont de Nemours Inc. DD, as each stock entered strong attribute territory earlier this week for the first time. As a reminder, a “strong attribute” stock is one that has at least 3 of the 5 total attributes possible in its favor. For a study on the quantitative benefits of owning strong attribute stocks, see our technical attribute research paper here.

DowDupont, a culmination of Dow Chemical and the 217-year old El du Pont de Nemours, separated its business into three distinct chemical companies last year. For those curious about the distinction, according to Barron’s: Dow focuses on commodity chemical production, DuPont on specialty chemical production, and Corteva on agricultural chemicals (Source: Barron’s.com). Since the breakup, the stock market has been generally unkind to the new shares. Dow, Inc. DOW (a member of the Dow Jones Industrial Average DJIA), DuPont de Nemours Inc. DD, and Corteva Inc. CTVA generally trended lower in 2019 and throughout the first quarter of 2020, dampening current year-to-date return figures of -33.89%, -23.88%, and -15.12% for the three companies, respectively (through 5/20). That said, since posting a bottom at the end of March, shares of DOW and DD have gained notable momentum, most recently breaking through their respective bearish resistance lines to reach strong attribute territory earlier this week on May 18th.

As for DOW and DD, this is the first time the two entities have possessed strong technical attribute ratings at the same time, and more interestingly, the deciding event occurred on the very same day. DOW currently trades on a Point & Figure buy signal, in a positive trend, and is testing resistance at the $38 level and has initial support available at $31 which is also where the bullish support line currently lies. DD also trades on a Point & Figure buy signal, in a positive trend, and sits against resistance at $49 and has initial support available at $42. To monitor for further improvements in the technical attribute ratings for each stock, make sure to click the “Set Activity Alert” button and toggle on “Positive Attribute Changes” at the bottom of the list.

*For those reviewing the relative strength (RS) sections for DOW, DD, or CTVA and noticing the asterisk to the right of a signal, this is telling us that there is not yet enough chart information to determine a “true” signal. A “true” signal is defined as a column of Xs or Os advancing higher or lower, respectively, than the previous column and requires at least 3 columns to determine. For that matter, such will not count in favor of a security’s technical attribute rating until a “true” signal is given. Note this can be a common finding with newly traded names.