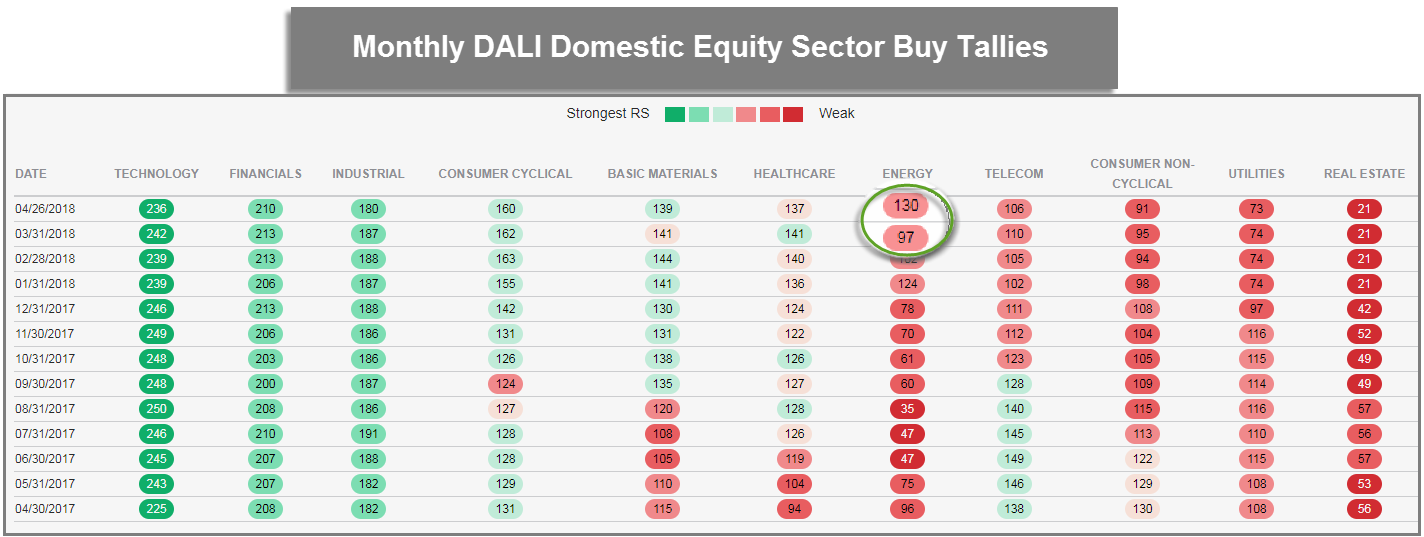

Thus far in April, Energy is by far the most improved domestic equity sector in DALI, having gained 33 buy signals since March 31.

- Upcoming Webinar: Please join us on Wednesday, May 9th at 11 am EST for a live webinar discussing the Oppenheimer Revenue ETF line up and the Oppenheimer US Revenue Model! Click here to register.

Thus far in April, Energy is by far the most improved domestic equity sector in DALI, having gained 33 buy signals since March 31. Actually, Energy is the only sector to have gained buy signals, as it has siphoned signals from every other domestic equity sector, with the exception of Real Estate. The biggest contributor to Energy's gain has been the Oil sub-sector, which has accumulated 16 of the 33 buy signals and currently sits a column of X’s against every other constituent of the DALI sector matrix. In fact, if the matrix is ranked by the number of relative strength charts in X’s, each of the top four funds belong to the Energy sector, reflecting the significant improvement of the sector over the short-term.