There are changes to two Invesco models this week.

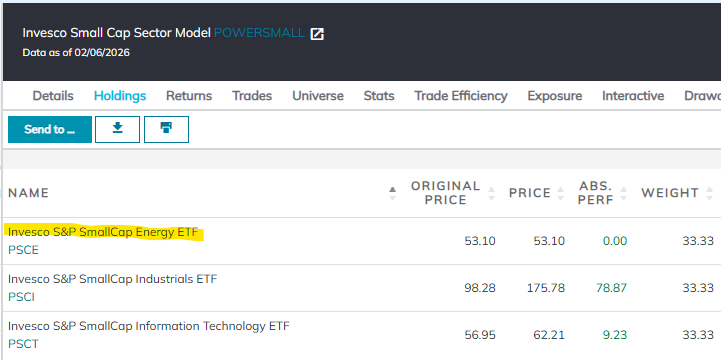

There are changes to two Invesco models this week. The Invesco Small Cap Sector Model (POWERSMALL) sold the Invesco S&P Smallcap Financials ETF (PSCF) and bought the Invesco S&P Smallcap Energy ETF (PSCE). PSCF was sold because its rank in the model’s relative strength matrix fell below the threshold to remain a holding in the model. In its place, the model added PSCE as it was the highest-ranking fund in the matrix that was not already a model holding. PSCE currently has a strong 5.41 fund score, which is 1.14 points better than the average for all energy and natural resource funds, and a positive 5.24 score direction. On its default chart, PSCE has completed three consecutive buy signals and reached a new 52-week high in last week’s trading. Year-to-date (through 2/6) PSCE has gained 23.57% on a price return basis; the fund also carries a 2.04% yield.

In addition to PSCE, POWERSMALL also has exposure to industrials and technology. Year-to-date, the model has gained 11.65%, while the Russell 2000 (RUT) is up 7.59%.

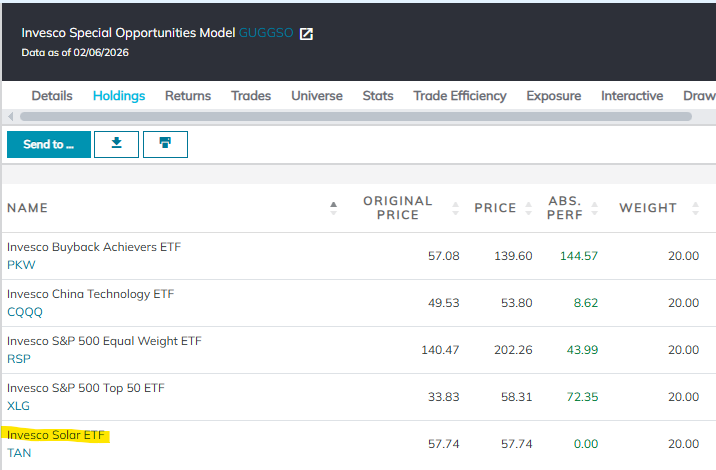

The Invesco Special Opportunities Model (GUGGSO) sold the Invesco Bloomberg Analyst Rating Improvers ETF (UPGD) and bought the Invesco Solar ETF (TAN). UPGD was sold because its rank in the model’s relative strength matrix fell below the threshold to remain a holding in the portfolio. In its place, the model added TAN as it was the highest-ranking fund in the matrix that was not already a holding in the model. TAN currently has a near-perfect 5.86 fund score, which is 1.59 points better than the average for all energy and natural resources funds, and a positive 1.37 score direction. On its default chart, TAN has completed two consecutive buy signals and reached a new multi-year high earlier this month. Year-to-date, TAN has gained 17.55% on a price return basis.

In addition to TAN, GUGGSO also has exposure to buybacks, Chinese technology, the S&P 500 equal weight, and the S&P 500 top 50. Year-to-date, GUGGSO has gained 3.45%.