There are changes to two Invesco models this week.

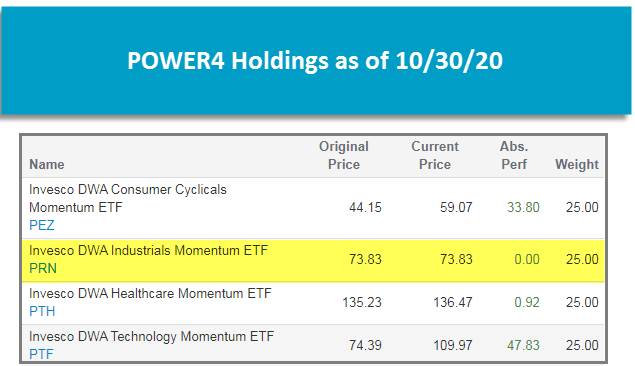

There are changes to two Invesco models this week. The DWA Sector 4 Model POWER4 bought the Invesco DWA Industrials Momentum ETF PRN and sold the Invesco DWA Basic Materials Momentum ETF PYZ. PYZ was removed from the model because materials fell out of the top four in the model’s sector rankings. In place of PYZ, the model added PRN because industrials moved into the top four sectors in the rankings. In addition to industrials, the model also has exposure to consumer cyclicals, healthcare, and technology. This is the eleventh change to the model this year. Year-to-date (through 10/30), POWER4 has returned 2.1%, outpacing the S&P 500 SPX, which is up 1.21%, by about 90 basis points.

The Invesco Dynamic Equal Weight Sector Model GUGGEWSECT sold the Invesco S&P Equal Weight Materials ETF RTM and added the Invesco S&P Equal Weight Healthcare ETF RYH. RTM was removed because materials fell out of the top three in the model’s sector rankings. RYH was added in place of RTM as healthcare has moved into the top three sectors in the rankings. This is the ninth change to the model this year. In addition to healthcare, the model also has exposure to consumer discretionary and technology. Year-to-date, GUGGEWSECT is down -18.31%.