There are changes to two Invesco models this week.

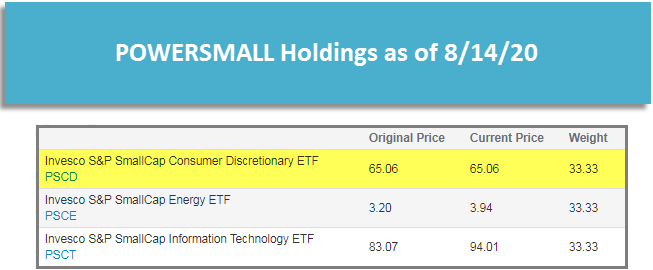

There are changes to two Invesco models this week. First, the Invesco Small Cap Sector Model POWERSMALL sold the Invesco S&P Smallcap Healthcare ETF PSCH and added the Invesco S&P Smallcap Consumer Discretionary ETF PSCD.

PSCH was removed because its rank in the model’s relative strength matrix fell below the threshold to remain a holding in the model. In place of PSCH, the model added PSCD as it was the highest-ranking fund in the model matrix that was not already a holding in the portfolio. This is the fourth change to the model this year. PSCD currently has a strong 5.62 fund score and positive 5.50 fund score direction. On its default chart, PSCD has completed three consecutive buy signals, most recently breaking a double top at $58 in late July. Year-to-date (through 8/14) PSCD has gained 2.06% on a price return basis, outperforming the Russell 2000 RUT which is down -5.43%. In addition to consumer discretionary, the model now also has exposure to energy and technology.

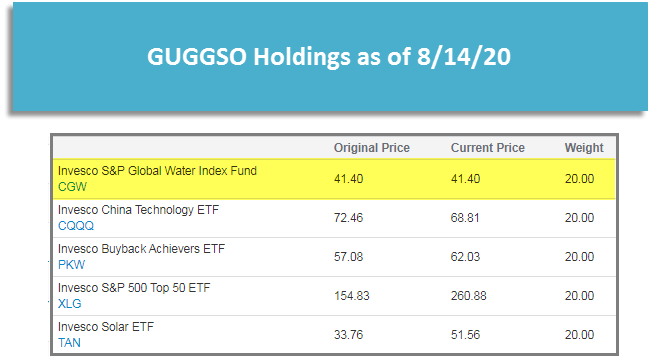

Second, Invesco Special Opportunities Model GUGGSO sold the Invesco S&P Equal Weight ETF RSP and bought the Invesco S&P Global Water Index Fund CGW. RSP was removed because its rank in the model’s relative strength matrix fell below the threshold to remain a holding in the portfolio. In the place of RSP, the model added CGW because it was the highest-ranking fund in the matrix that was not already a holding in the model. CGW currently has a favorable 3.51 fund score and positive 2.21 fund score direction. Year-to-date (through 8/14) CGW has gained 0.66% on a price return basis. The full model holdings can be seen below.