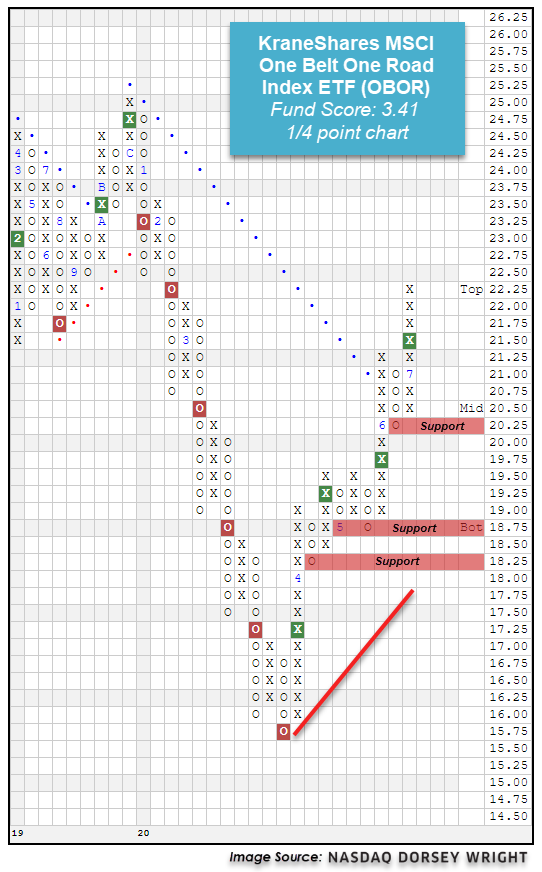

There were no changes to the KraneShares Dynamic China Rotation Model this week. We spotlight further improvement in the KraneShares MSCI One Belt One Road Index ETF (OBOR).

There were no changes to the KraneShares Dynamic China Rotation Model this week, as each of the holdings continued to maintain sufficient relative strength against the Chinese fixed income representative.

Broad Chinese equities have continued to demonstrate strength over the past week, leading to many areas outside the Chinese borders to benefit from this push higher. One such fund that seeks to capitalize on improvement from the Chinese economy without a specific focus on Chinese equities is the KraneShares MSCI One Belt One Road Index ETF OBOR. This ETF seeks to take advantage of the One Belt One Road initiative from China, which aims at modernizing the original Silk Road trading routes through cooperation agreements with 134 countries and international organizations (source: kraneshares.com).

The fund has shown continued upside participation over the past several weeks, rising off its all-time low of $15.75 in March to give four consecutive buy signals on its more sensitive ¼ point per box chart. OBOR also moved back to a positive trend in early June and has seen its fund score improve drastically to a recent posting of 3.41, which bests the average infrastructure fund of 3.17 as well as the average global equity fund of 3.28, paired with a strongly positive 3.01 score direction. Furthermore, the fund also carries a yield of 4.69% and saw monthly momentum recently flip positive, suggesting the potential for higher prices from here. The overall technical picture of the fund continues to improve, however, those looking to add exposure may be best served by waiting for a pullback or normalization of the trading band as the recent price movement has left OBOR in heavily overbought territory. Initial support can be found on the ¼ point chart at $20.25 with further support offered at $18.75 and $18.25.