There were no changes to the KraneShares Dynamic China Rotation Model this week, as each of the holdings continued to maintain sufficient relative strength against the Chinese fixed income representative.

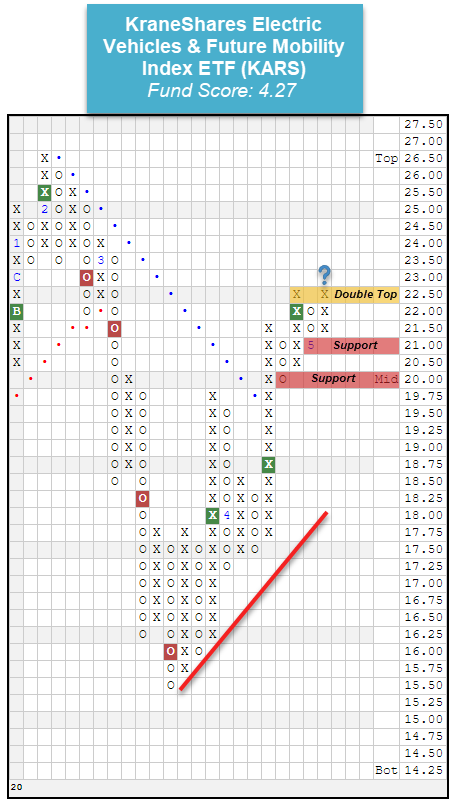

The past few weeks of market action have seen some surprising continued improvement from the KraneShares Electric Vehicles & Future Mobility Index ETF KARS, which seeks to invest in global companies that are engaged in the production of electric vehicles, their components, as well as any other companies that are focused on changing the future of mobility (source: kraneshares.com). The fund fell significantly from its February high of $26.50 to give four consecutive sell signals, ultimately falling to an all-time low of $15.50 on March 19th. Since that time, however, the fund has demonstrated notable improvement, moving higher to give two consecutive buy signals before breaking through to a positive trend at $19.75 and giving its third consecutive buy signal at $22. The fund has most recently moved higher over the past week to reverse back up into a column of X's and set up a double top formation at $22.50, with movement to $23 marking another buy signal. KARS has also shown advancement from a fund score perspective, with it possesses an ideal 4.27 fund score and a strongly positive 2.98 fund score direction. Those looking to gain exposure to KARS may consider the fund at current levels or upon a breakout at $23, with initial support offered at $21 and further support found at $20. From there, support may be found at the bullish support line, which currently sits at $18.

The table below is a review of important technical data on a select group of KraneShares ETFs. Significant changes within the past week are highlighted in Green if positive or Red if negative. This portfolio is designed to be used as a "radar" screen to bring your attention to potentially important technical changes that may require your attention and potential action. When evaluating the Fund Score, the strongest issues have scores of 4 or higher while those ETFs with scores below a 3 are no longer considered solid citizens.

| Symbol | Name | Price | Yield (%) | PnF Trend | RS Signal | RS Col. | 200 Day MA | Weekly Mom | OBOS (Weekly) | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| KALL | KraneShares MSCI All China Index ETF | 25.02 | 1.53 | Negative | Sell | X | 24.75 | +5W |

|

||

| KARS | KraneShares Electric Vehicles & Future Mobility Index ETF | 22.57 | 1.93 | Positive | O | 21.78 | +5W |

|

|||

| KBA | KraneShares Bosera MSCI China A ETF | 31.56 | 1.58 | Positive | Buy | X | 31.02 | +4W |

|

||

| KCCB | KraneShares CCBS China Corporate High Yield Bond USD ETF | 38.21 | 4.80 | Negative | X | 40.29 | +4W |

|

|||

| KCNY | Kraneshares E Fund China Commercial Paper ETF | 31.14 | 2.79 | Negative | Sell | O | 32.27 | +5W |

|

||

| KEMQ | KraneShares Emerging Markets Consumer Technology Index ETF | 22.04 | 1.91 | Positive | O | 22.38 | +5W |

|

|||

| KEMX | KraneShares MSCI Emerging Markets EX China Index ETF | 19.35 | 3.81 | Negative | O | 24.02 | +5W |

|

|||

| KFYP | KraneShares CICC China Leaders 100 Index ETF | 25.46 | 0.20 | Negative | Sell | X | 26.62 | +5W |

|

||

| KGRN | KraneShares MSCI China Environment Index ETF | 17.88 | 6.09 | Negative | O | 17.93 | +4W |

|

|||

| KMED | KraneShares Emerging Markets Healthcare Index ETF | 22.99 | 1.65 | Positive | X | 21.41 | +5W |

|

|||

| KURE | KraneShares MSCI All China Health Care Index ETF | 26.63 | 0.21 | Positive | X | 23.25 | +5W |

|

|||

| KWEB | KraneShares CSI China Internet ETF | 49.84 | 0.08 | Positive | Sell | X | 46.17 | +5W |

|

||

| OBOR | KraneShares MSCI One Belt One Road Index ETF | 19.25 | 5.44 | Negative | O | 22.12 | +5W |

|

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time to give us a general picture of whether the KraneShares ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong relative strength ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness. Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell.

Average Level 18.98

Legend:

- UPPERCASE indicates that the RS chart is on a buy signal.

- lowercase indicates that the RS chart is in a sell signal.

- GREEN lettering indicates the ETFs trend chart is on a buy signal.

- RED lettering indicates the ETF is on a sell signal.

- Box Color indicates the Sector Status Rating. Green = Favored, Yellow = Average, and Red = Unfavored.

The KraneShares Dynamic China Rotation Model is designed to identify major themes in the Chinese marketplace through the use of the Point & Figure relative strength tools. For more information on the portfolio construction and back testing, see the model info file on the models page. (Note: The KraneShares ETF Models will be updated Tuesday mornings by 9:30 am EST)

Weekly Changes:

KraneShares Dynamic China Rotation Model (TR) KRANEDYNAMIC.TR

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| KraneShares MSCI All China Health Care Index ETF TR | KURE.TR | 25.000% | 0.2110 | 03/30/2020 |

| KraneShares Bosera MSCI China A ETF TR | KBA.TR | 25.000% | 1.5700 | 02/25/2019 |

| KraneShares MSCI All China Index ETF TR | KALL.TR | 25.000% | 1.5320 | 08/29/2016 |

| KraneShares Emerging Markets Healthcare Index ETF TR | KMED.TR | 25.000% | 1.6570 | 11/04/2019 |

* - Dates prior to 10/15/2019, which is when the KraneShares Dynamic China Rotation Model became available on the NDW Research Platform, are representative of when the position was added to the backtested model.