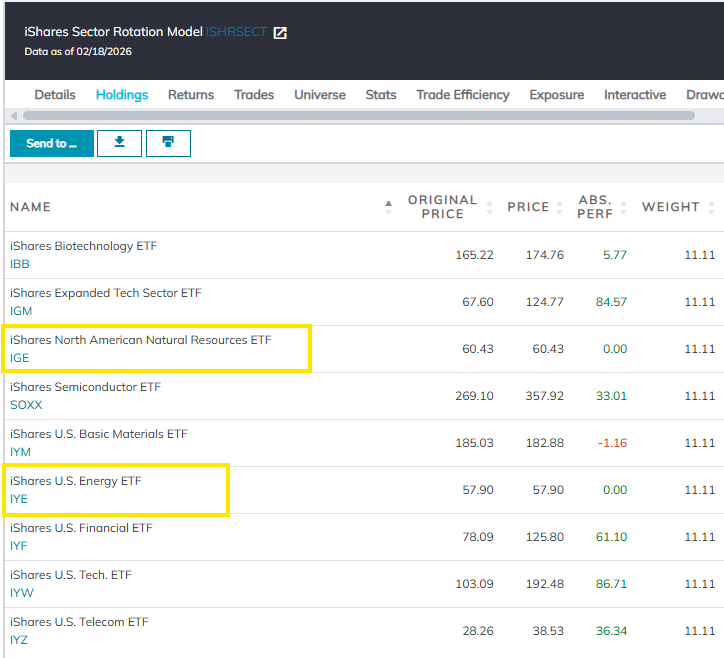

There are changes to two iShares models this week. The iShares Sector Rotation Model ([ISHRSECT]) bought the iShares North American Natural Resources ETF ([IGE]) and the iShares US Energy ETF ([IYE]).

There are changes to two iShares models this week. The iShares Sector Rotation Model (ISHRSECT) bought the iShares North American Natural Resources ETF (IGE) and the iShares US Energy ETF (IYE). ISHRSECT utilizes a relative strength versus benchmark methodology which compares each fund in the model universe against the iShares Dow Jones US ETF (IYY). Those funds showing near-term relative strength against the benchmark (i.e., are in a column of Xs) are included in the portfolio and are removed only when they show weakness relative to the benchmark. When an addition or deletion is made, the portfolio is rebalanced so each position is equally weighted.

IGE and IYE were added because both funds reversed up on their respective relative strength charts versus IYY, demonstrating short-term relative strength against the benchmark. IGE currently has a strong 5.75 fund score, which is 1.37 points better than the average for all energy and natural resources funds, and a positive 4.33 score direction. Year-to-date (through 2/18), the fund has gained 20.38% on a price return basis and also carries a 2.1% yield. IYE currently has a favorable 4.55 fund score, which is 0.17 points better than the average for all energy and natural resources funds, and a positive 3.06 score direction. Year-to-date, IYE has gained 21.82% on a price return basis and carries a 2.5% yield.

In addition to IGE and IYE, ISHRSECT also has exposure to biotechnology, technology, semiconductors, basic materials, financials, and telecom. Year-to-date, ISHRSECT has gained 2.47% while the S&P 500 (SPX) is up 0.52%.

The iShares Tactical Model (ISHRTACTICAL) sold the iShares US Consumer Discretionary ETF (IYC) and bought the iShares US Oil Equipment & Services ETF (IEZ). IYC was sold because its rank in the model’s relative strength matrix fell below the threshold to remain a holding in the model. In its place, the model added IEZ as it was the highest-ranking fund in the matrix that was not already a model holding.

IEZ currently has a near-perfect 5.80 fund score, which is 1.42 points better than the average for all energy and natural resources funds, and a positive 3.21 score direction. Year-to-date IEZ has gained 35.03% on a price return basis and carries a 1.5% yield. In addition to IEZ, ISHRTACTICAL also has exposure to gold, the S&P 500, semiconductors, silver, aerospace & defense, US broker dealers & securities exchanges, and industrials. Year-to-date, the model has gained 7.06%.