With no changes to any of the iShares models this week, we take a look at the iShares US Basic Materials ETF (IYM).

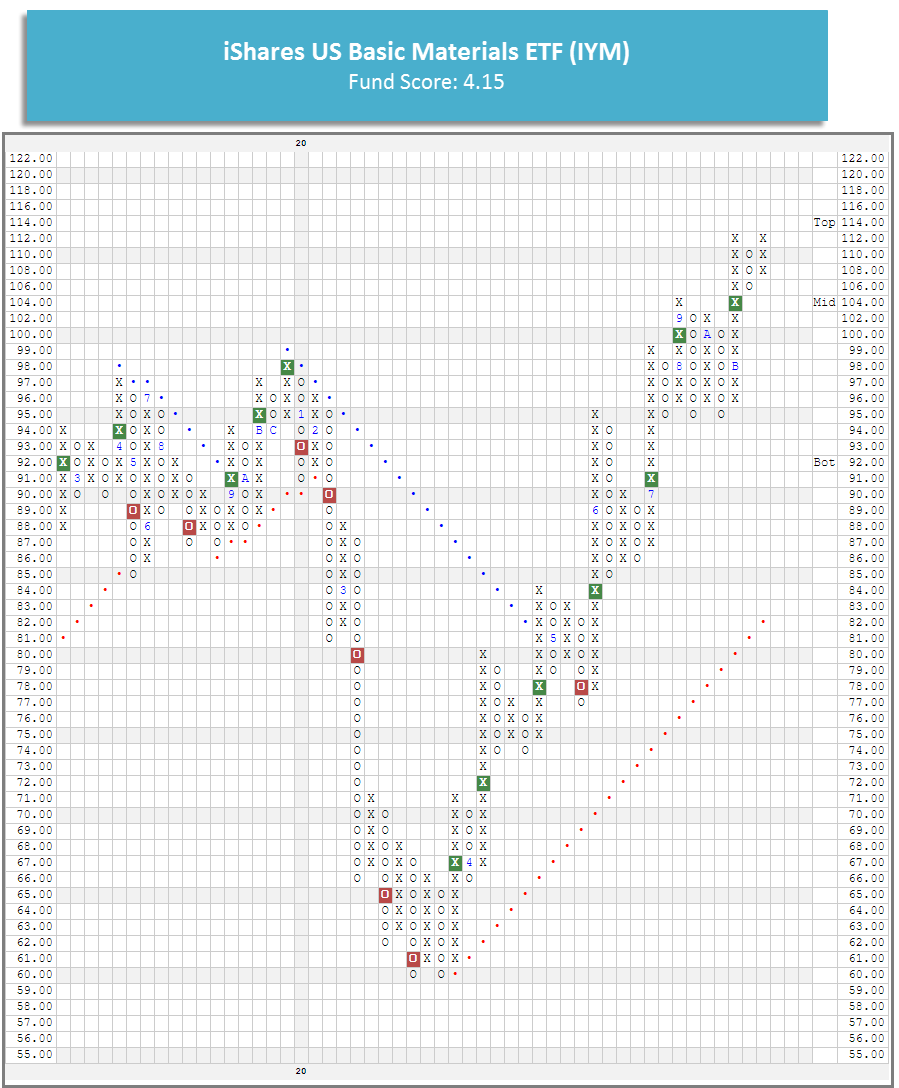

There are no changes to any of the iShares models this week. Last week, the basic materials sector moved into the top four spots in the DALI domestic equity rankings. Those looking to take advantage of the strength of this sector should consider the iShares US Basic Materials ETF IYM. IYM currently has a favorable 4.15 fund score, 0.18 points better than the average for all materials sector funds. On its default chart. IYM has given four consecutive buy signals and sits one box away from giving a fifth with a double top breakout at $114. Which would also mark a new all-time high for the fund. Year-to-date (through 12/9) the fund gas generated a price return of 14.63%. With weekly overbought/oversold reading of 69%, IYM is verging on heavily-overbought territory, so those interested in adding exposure should may be best served to do so on a slight pullback. IYM has most recently found support at $106, with additional support found at $95.