The international equities asset class has seen continued long-term weakness from a relative-strength perspective, as it remains in the last place on our broad asset class ranking in DALI after falling to that position in March. Foreign equities have improved on an absolute basis over the past several weeks, in line with near-term strength from domestic equities, however, this improvement has been significantly more muted. The broad asset class has gained some buy signals in the DALI rankings, rising from a low of 65 signals to a recent posting of 82, although it still sits 30 signals below commodities.

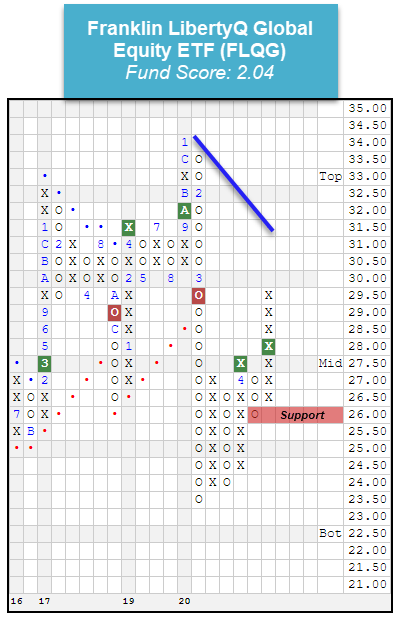

While the relative strength picture has remained largely unchanged, we have noticeable improvement taking place across many of the individual trend charts of broad global equity funds, in both developed and international market representatives. One such global fund is the Franklin LibertyQ Global Equity ETF FLQG, which has risen up from a near-term low of $23.50 to give two consecutive buy signals during its ascent to recent levels at $29.50. While this chart level is certainly improved, the fund still sits in an overall negative trend, although recent strength has led FLQG to near its long-term bearish resistance line that currently sits at $31.50, four boxes north of current levels. FLQG also offers a 3.61% yield and has a low relative-risk (rRisk) score of 0.87, making this a name to keep an eye out for further improvement in the weeks to come. Initial support can be found at $26.

This section of the report categorizes select Franklin ETFs by their respective broad group. Along with each group, you can view the Average Group Score, which is an average of the scores of all funds represented in that particular group. Those Franklin ETFs that meet or exceed the Average Group Score will be highlighted in green in order to easily view those ETFs that have superior strength within their respective group. You want to focus on those ETFs that exhibit superior strength when looking to add new exposure to a particular group.

| Treasury Bonds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 4.1 | FTSD | Franklin Liberty Short Duration US Government ETF | 2.69 |

| Municipal Bonds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.4 | FLMB | Franklin Liberty Municipal Bond ETF | 2.75 |

| FLMI | Franklin Liberty Intermediate Municipal Opportunities ETF | 2.19 |

| Broad Fixed Income | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.3 | FLQD | LibertyQ Global Dividend ETF | 1.04 |

| High Yield | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.9 | FLHY | Franklin Liberty High Yield Corporate ETF | 2.21 |

| FLBL | Franklin Liberty Senior Loan ETF | 1.15 |

| Global Fixed Income | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.9 | FLIA | Franklin Liberty International Aggregate Bond ETF | 2.08 |

| Corporate Bonds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.9 | FLCO | Franklin Liberty Investment Grade Corporate ETF | 2.22 |

| Large Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.8 | FLQL | Franklin LibertyQ US Equity ETF | 2.89 |

| Global Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.5 | FLTW | Franklin FTSE Taiwan ETF | 4.59 |

| FLSW | Franklin FTSE Switzerland ETF | 3.99 | |

| FLCH | Franklin FTSE China ETF | 3.34 | |

| FLKR | Franklin FTSE South Korea ETF | 2.97 | |

| FLJH | Franklin FTSE Japan Hedged ETF | 2.72 | |

| FLAX | Franklin FTSE Asia Ex Japan ETF | 2.55 | |

| FLRU | Franklin FTSE Russia ETF | 2.09 | |

| FLQG | Franklin LibertyQ Global Equity ETF | 2.04 | |

| FLCA | Franklin FTSE Canada ETF | 1.79 | |

| FLJP | Franklin FTSE Japan ETF | 1.66 | |

| FLQE | Franklin LibertyQ Emerging Markets ETF | 1.56 | |

| FLGR | Franklin FTSE Germany ETF | 1.55 | |

| FLQH | LibertyQ International Equity Hedged ETF | 1.29 | |

| FLIN | Franklin FTSE India ETF | 1.03 | |

| FLHK | Franklin FTSE Hong Kong ETF | 0.93 | |

| FLAU | Franklin FTSE Australia ETF | 0.83 | |

| FLEE | Franklin FTSE Europe ETF | 0.75 | |

| FLIY | Franklin FTSE Italy ETF | 0.70 | |

| FLMX | Franklin FTSE Mexico ETF | 0.58 | |

| FLGB | Franklin FTSE United Kingdom ETF | 0.53 | |

| FLFR | Franklin FTSE France ETF | 0.28 | |

| FLBR | Franklin FTSE Brazil ETF | 0.04 |

| Mid Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 2.3 | FLLV | Franklin Liberty U.S. Low Volatility ETF | 3.27 |

| FLQM | Franklin LibertyQ U.S. Mid Cap Equity ETF | 3.02 |

| Small Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 1.9 | FLQS | Franklin LibertyQ U.S. Small Cap Equity ETF | 0.82 |

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time to give us a general picture of whether the Franklin ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong relative strength ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness. Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell.

Average Level 6.50

Legend:

- UPPERCASE indicates that the RS chart is on a buy signal.

- lowercase indicates that the RS chart is in a sell signal.

- GREEN lettering indicates the ETFs trend chart is on a buy signal.

- RED lettering indicates the ETF is on a sell signal.

- Box Color indicates the Sector Status Rating. Green = Favored, Yellow = Average, and Red = Unfavored.