There are changes in both the First Trust Fixed Income ETF Model as well as the First Trust Size & Style Model.

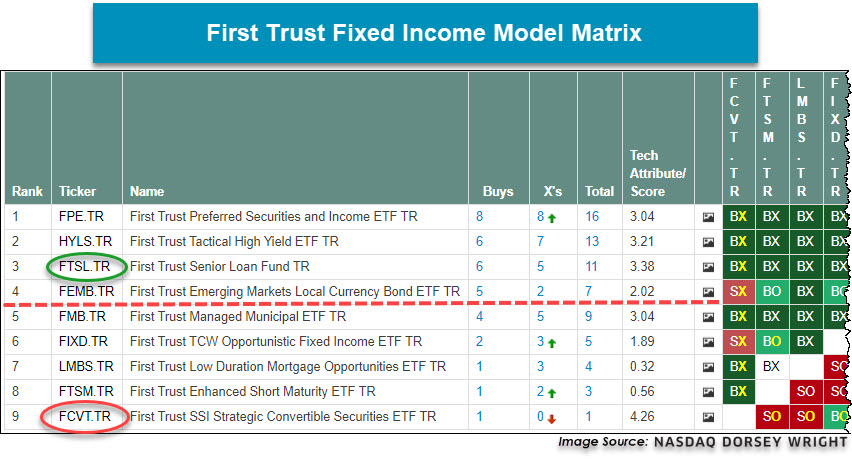

In the First Trust Fixed Income Model the First Trust SSI Strategic Convertible Securities ETF FCVT is being removed after having been a member of the model since April 2020, over which time FCVT is up more than 65% while the Core Bond ETF AGG is actually down a little over 2% over that time period. Nonetheless, FCVT has fallen in it’s relative strength rankings down to the bottom of the matrix. As a result, FCVT is being removed from the Fixed Income Model and is being replaced with the First Trust Senior Loan Fund FTSL, which is joining Preferreds FPE, High Yield HYLS, and Emerging Market Bonds FEMB as the four holdings of the Model. FTSL has a positive technical picture with a score above 3, and has a yield of 3.33%, which is more than twice the yield of FCVT. The Fixed Income Model is up 0.3% so far this year compared to -3.5% return for the Cored Bond ETF AGG and the Model is up more than 37% over the past year versus 5.5% for AGG.

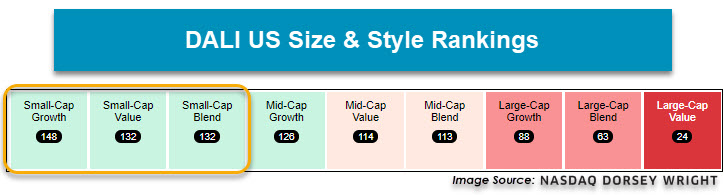

The other model that is seeing a change this week is the First Trust Size & Style Model. For the second time this year the Size & Style model is seeing a change, and once again the change is increasing the Small Cap exposure. Small Cap Value moved into the top three style boxes within the DALI rankings over the course of the month pushing Mid Cap Growth back to number four in the Style Box rankings. As a result, the First Trust Mid Cap Growth AlphaDEX FNY is being removed from the Size & Style Model and is being replaced with the First Trust Small Cap Value ETF FYT. With this change, 100% of the model is allocated to Small Caps and so far this year (through 3/23) the Model is up more than 12% versus 5% for the S&P 500.