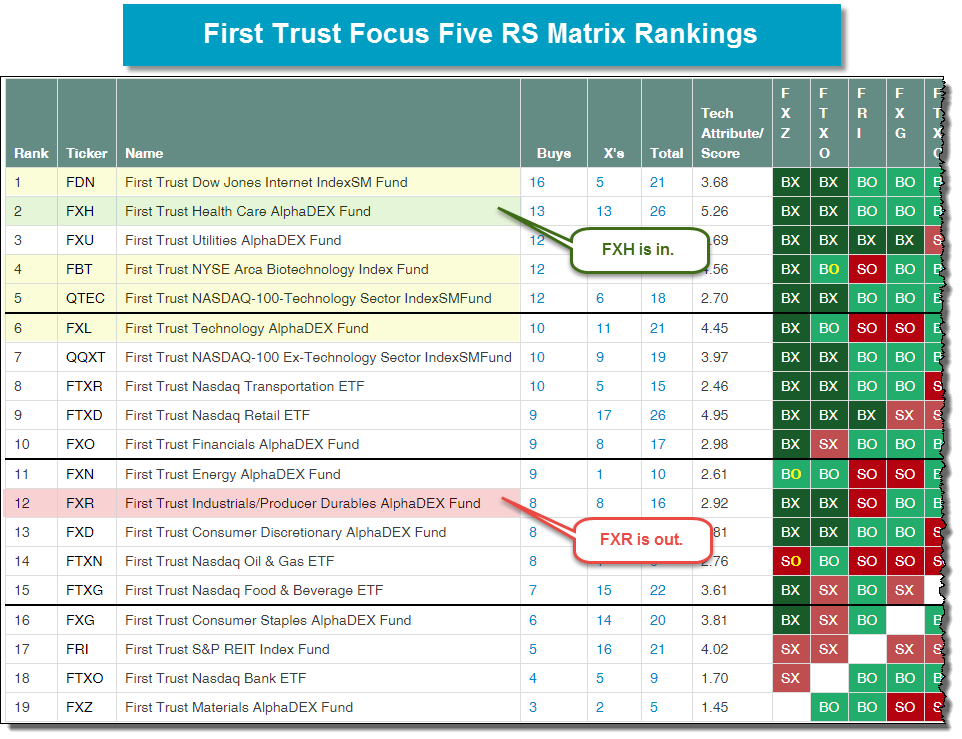

There is a change is the First Trust Focus Five Model FTRUST5 – Industrials FXR out, Healthcare FXH in.

For the second time in 2018 there is a change to the First Trust Focus Five Model FTRUST5, and the change this week is removing the First Trust Industrials AlphaDEX ETF FXR and replacing it with the First Trust Healthcare AlphaDEX FXH. FXR had been a holding in the model for nearly two years, and while it was a member of the model FXR was up 17.7%. However, over the course of the past couple of weeks FXR has fallen out of the top half of the relative strength matrix ranking, thus causing its removal from the model. As per the rules of the Focus Five Model, once a positions falls out, it is then replaced with the highest ranking sector that is not currently a member of the model which in this case is FXH that currently sits at the number two position in the relative strength matrix. Therefore, FXH joins the other members of the Focus Five Model this week, which include Biotech FBT, Internet FDN, Nasdaq-100 Technology QTEC, and AlphaDEX Technology FXL.