With the quarter coming to a close last week, we wanted to take this time to do our customary quarterly and yearly review of the First Trust Models.

With the quarter coming to a close last week, we wanted to take this time to do our customary quarterly and yearly review of the First Trust Models. Overall, the fourth quarter was positive for a majority of the Models. With that, we will cover how the Models performed and discuss any changes that may have occurred.

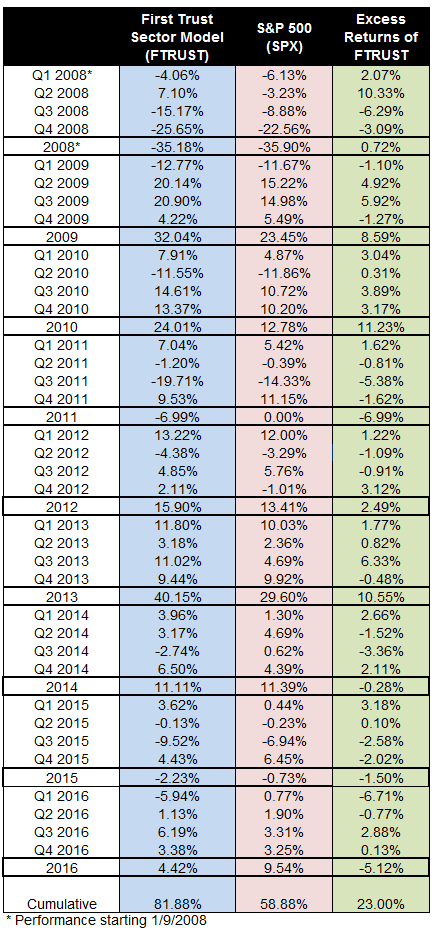

First Trust Sector Rotation Model FTRUST

The First Trust Sector Rotation Model did well this quarter and finished up 3.38%, which outpaced the 3.25% of the S&P 500 Index SPX. There were five additions to the Sector Model during the quarter and they are as follows: the First Trust Nasdaq Food & Beverage ETF FTXG, the First Trust Nasdaq Semiconductor ETF FTXL, the First Trust Nasdaq Bank ETF FTXO, First Trust Water ETF FIW, and the First Trust Materials AlphaDEX Fund FXZ. There were no deletions to the Sector Model this quarter. Although the Model lagged the SPX for 2016, the long term outperformance by the Model over the Index is still in excess of 20%.

*The performance numbers above are pure price returns, not inclusive of dividend or all transaction costs. Potential for profits is accompanied by possibility of loss. Past performance is not indicative of future results.

First Trust Focus Five Model FTRUST5

The First Trust Focus Five Model also had a positive quarter as it gained 1.17%, which lagged the SPX at 3.25%. There were two changes that occurred during the fourth quarter. The first took place on November 9th as the First Trust NASDAQ-100- Technology Sector Index Fund QTEC replaced the First Trust Consumer Discretionary AlphaDEX Fund FXD. The second change was on November 22nd, and involved the addition of the First Trust Industrials/Producer Durables AlphaDEX Fund FXR and the deletion of the First Trust Consumer Staples AlphaDEX Fund FXG. The year proved to be tough for the Focus Five Model as the strategy experienced four changes over the course of the year adapting to new market trends, and rotating out of leadership trends that, in some cases, had been in tact for years. This model underperformed the SPX in three out of four quarters this year, and underperformed on a YTD basis, as well. The last time this strategy saw three quarters of underperformance in a calendar year was 2011, which was a year that experienced similar market volatility as well as model turnover as we saw in 2016. In 2011, there were five model changes. So, while the long term performance of the model (since October 2009) continues to show outperformance versus the SPX (154% versus 107%), 2016 will go down as just the second full calendar year of underperformance for this strategy in the past seven years.

*The performance numbers above are pure price returns, not inclusive of dividend or all transaction costs. Potential for profits is accompanied by possibility of loss. Past performance is not indicative of future results.

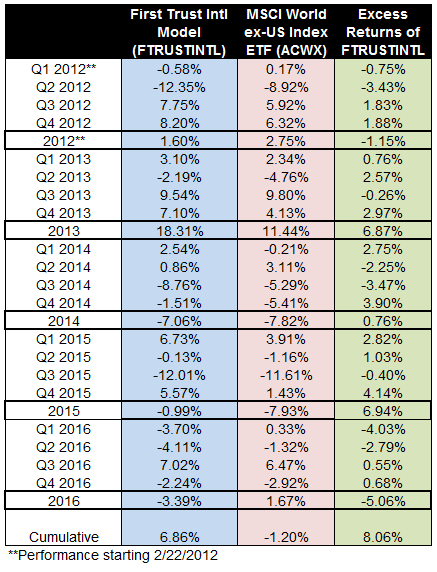

First Trust International Model FTRUSTINTL

The fourth quarter proved to be tough for the First Trust International Model, but the same could be said for International Equities as a whole. For the quarter, the FTRUSTINTL Model lost -2.24%, but it did manage to outperform its benchmark by 0.68%. There were no changes to the First Trust International Model this quarter. On a year-to-date basis, FTRUSTINTL did underperform its benchmark by about 5%, which has been consistent with relative strength/momentum based strategies in 2016. On a longer term basis, since Q1 2012 the model continues to shows outperformance of the benchmark by about 8%.

*The performance numbers above are pure price returns, not inclusive of dividend or all transaction costs. Potential for profits is accompanied by possibility of loss. Past performance is not indicative of future results.

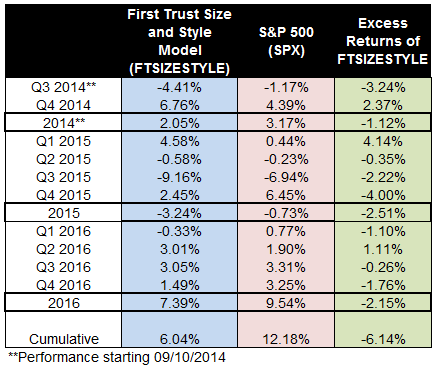

First Trust Size and Style Model FTSIZESTYLE

The fourth quarter was positive for the First Trust Size and Style Model as it gained 1.49%, which slightly lagged the SPX at 3.25%. There was one change to the FTSIZESYTLE Model and it involved the addition of the First Trust Small Cap Growth AlphaDEX Fund FYC and the deletion of the First Trust Mid Cap Growth AlphaDEX Fund FNY. Although, FTSIZESTYLE lagged the SPX on a year-to-date basis, it did have one of its better years since its inception and gained 7.39%.

*The performance numbers above are pure price returns, not inclusive of dividend or all transaction costs. Potential for profits is accompanied by possibility of loss. Past performance is not indicative of future results.

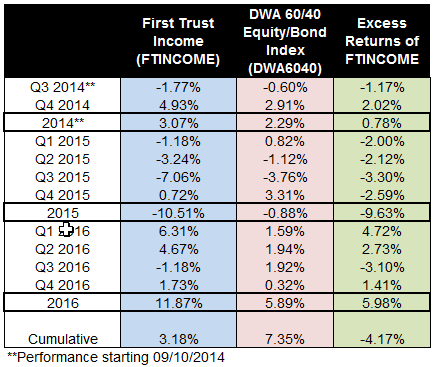

First Trust Income Model FTINCOME

For the quarter, the First Trust Income Model gained 1.73%, which outperforms its benchmark, the DWA 6040 Index DWA6040, by 1.41%. There was one change that occurred during the quarter, and it involved the addition of the First Trust NASDAQ Technology Dividend Index Fund TDIV and the deletion of the First Trust S&P REIT Index Fund FRI. Year-to-date, the FTINCOME Model was the top performing Model this year as it gained 11.87% and outperformed its benchmark by roughly 6%.

*The performance numbers above are pure price returns, not inclusive of dividend or all transaction costs. Potential for profits is accompanied by possibility of loss. Past performance is not indicative of future results.