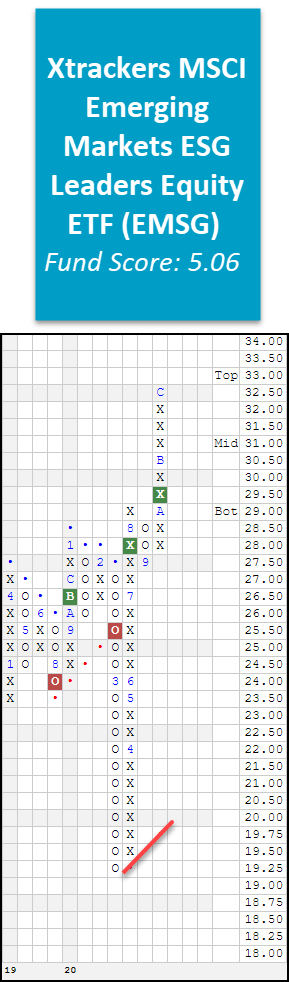

There are no changes to report this week. Today, we want to bring the chart of the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF (EMSG)

There are no changes to report this week. Today, we want to bring the chart of the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF EMSG to your attention as it currently sits at all-time highs and trades on two consecutive buy signals. As a refresher, EMSG seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Emerging Markets ESG Leaders Index. The MSCI Emerging Markets (EM) ESG Leaders Index, is a capitalization-weighted index that provides exposure to companies with high Environmental, Social, and Governance (ESG) performance relative to their sector peers. MSCI EM ESG Leaders Index consists of large and mid-cap companies across 24 Emerging Markets (EM) countries. The Index is designed for investors seeking a broad, diversified sustainability benchmark with relatively low tracking error to the underlying equity market (source: DWS.com) In July, EMSG returned to a buy signal at $28 before breaking a second consecutive double top at $29.50 in October. Just this month, EMSG rallied to $32.50 which notched a new all-time high. From a scoring perspective, EMSG has a solid score of 5.06 and is outscoring the average emerging market equity fund by 0.73 score points, the average all Non-US fund by 1.20 score points, as well as the average all global & international fund by 1.23 score points. Currently, EMSG trades near the middle of the 10-week trading band with an overbought/oversold (OBOS%) reading of 14% overbought. From here, initial support sits at $27.50 while the bullish support line would be tested with a move to $19.75.