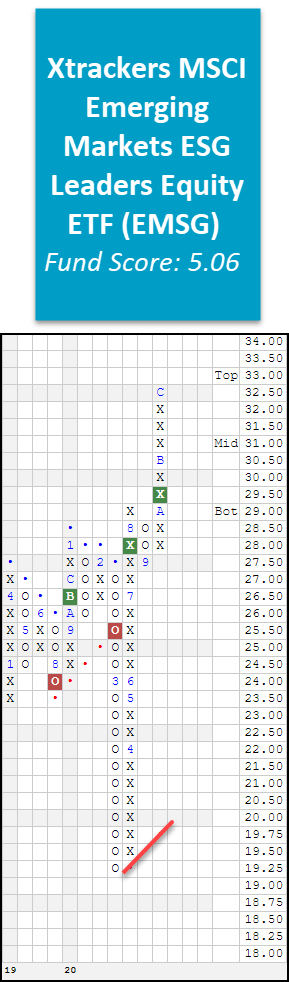

There are no changes to report this week. Today, we want to bring the chart of the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF EMSG to your attention as it currently sits at all-time highs and trades on two consecutive buy signals. As a refresher, EMSG seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Emerging Markets ESG Leaders Index. The MSCI Emerging Markets (EM) ESG Leaders Index, is a capitalization-weighted index that provides exposure to companies with high Environmental, Social, and Governance (ESG) performance relative to their sector peers. MSCI EM ESG Leaders Index consists of large and mid-cap companies across 24 Emerging Markets (EM) countries. The Index is designed for investors seeking a broad, diversified sustainability benchmark with relatively low tracking error to the underlying equity market (source: DWS.com) In July, EMSG returned to a buy signal at $28 before breaking a second consecutive double top at $29.50 in October. Just this month, EMSG rallied to $32.50 which notched a new all-time high. From a scoring perspective, EMSG has a solid score of 5.06 and is outscoring the average emerging market equity fund by 0.73 score points, the average all Non-US fund by 1.20 score points, as well as the average all global & international fund by 1.23 score points. Currently, EMSG trades near the middle of the 10-week trading band with an overbought/oversold (OBOS%) reading of 14% overbought. From here, initial support sits at $27.50 while the bullish support line would be tested with a move to $19.75.

The DWA Monthly Currency Hedge Ratings are designed to provide you with an objective confidence rating for the major currency pairs. The ratings are based upon 3-12 month price momentum inputs, using monthly cross-rate data, and ratings range from 0-4. For currencies weakening and experiencing negative momentum relative to the US Dollar, the hedge rating will be high. For currencies strengthening and experiencing positive momentum relative to the US Dollar, the hedge rating will be low. The hedge percentage (Hedge %) can range from 0 - 100%. For currencies with a high hedge rating, a larger currency hedge exposure is indicated. The Hedge % uses a sliding scale in increments of 25%. For example, a currency with a Hedge Rating of 3 has a suggested Hedge % of 75%.

The table below is a review of important technical data on a select group of DWS Xtrackers ETFs. Significant changes within the past week are highlighted in Green if positive or Red if negative. This portfolio is designed to be used as a "radar" screen to bring your attention to potentially important technical changes that may require your attention and potential action. When evaluating the Fund Score, the strongest issues have scores of 4 or higher while those ETFs with scores below a 3 are no longer considered solid citizens.

Symbol

Name

Price

Fund Score

PnF Signal

RS Col.

PnF Trend

Weekly Mom

ACSG

Xtrackers MSCI ACWI ex USA ESG Leaders Equity ETF

30.90

5.05

Buy

X

Positive

-2W

ASHR

Xtrackers Harvest CSI 300 China A-Shares ETF

38.94

4.73

Buy

X

Positive

-4W

ASHS

Xtrackers Harvest CSI 500 China A-Shares ETF

34.52

4.10

Buy

X

Positive

-4W

ASHX

Xtrackers MSCI 300 China A Inclusion Equity ETF

28.79

4.80

Buy

X

Positive

-4W

CN

Xtrackers MSCI All China Equity ETF

43.35

4.39

Buy

O

Positive

-4W

DBAW

Xtrackers MSCI All World ex US Hedged Equity ETF

30.26

2.59

Buy

O

Positive

-2W

DBEF

Xtrackers MSCI EAFE Hedged Equity ETF

33.76

2.41

Buy

O

Positive

-2W

DBEM

Xtrackers MSCI Emerging Markets Hedged Equity ETF

26.88

3.20

Buy

O

Positive

-2W

DBEU

Xtrackers MSCI Europe Hedged Equity ETF

30.24

2.36

Buy

O

Positive

-2W

DBEZ

Xtrackers MSCI Eurozone Hedged Equity ETF

33.14

2.51

Buy

O

Positive

-2W

DBGR

Xtrackers MSCI Germany Hedged Equity ETF

29.19

2.68

Buy

O

Positive

+7W

DBJP

Xtrackers MSCI Japan Hedged Equity ETF

45.40

3.92

Buy

O

Positive

-2W

DEEF

Xtrackers FTSE Developed EX US Comprehensive Factor ETF

29.92

2.83

Buy

O

Positive

-2W

DEUS

Xtrackers Russell 1000 Comprehensive Factor ETF

38.39

4.97

Buy

O

Positive

-2W

EASG

Xtrackers MSCI EAFE ESG Leaders Equity ETF

28.90

3.15

Buy

O

Positive

-2W

EMSG

Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF

31.51

5.06

Buy

O

Positive

-3W

EURZ

Xtrackers Eurozone Equity ETF

24.55

3.19

Buy

O

Positive

-1W

HAUZ

Xtrackers International Real Estate ETF

26.48

2.42

Buy

O

Positive

-2W

HDAW

Xtrackers MSCI All World ex US High Dividend Yield Equity ETF

23.93

2.78

Buy

O

Positive

-2W

HDEF

Xtrackers MSCI EAFE High Dividend Yield Equity ETF

23.10

2.89

Buy

O

Positive

-2W

JPN

Xtrackers Japan JPX-Nikkei 400 Equity ETF

32.20

3.14

Buy

O

Positive

-2W

SNPE

Xtrackers S&P 500 ESG ETF

32.68

5.25

Buy

O

Positive

-2W

USSG

Xtrackers MSCI USA ESG Leaders Equity ETF

33.82

5.05

Buy

O

Positive

-1W

Symbol

Name

Price

Fund Score

PnF Signal

RS Col.

PnF Trend

Weekly Mom

ESCR

X-Trackers Bloomberg Barclays US Investment Grade Corporate ESG ETF

22.81

2.51

Buy

O

Positive

-2W

ESEB

X-Trackers J.P. Morgan ESG Emerging Markets Sovereign ETF

22.49

2.51

Buy

O

Positive

-1W

ESHY

X-trackers J.P. Morgan ESG USD High Yield Corporate Bond ETF

21.04

2.58

Buy

O

Positive

-2W

RVNU

Xtrackers Municipal Infrastructure Revenue Bond ETF

29.19

3.24

Sell

O

Positive

-1W

The ETFs with the most relative strength buy signals (suggesting outperformance) versus the others in the group are listed at the top. These ETFs should be overweighted in the portfolio. Those ETFs with the least amount of relative strength buy signals versus the others in the group are listed at the bottom. These ETFs should be underweighted in the portfolio.

Xtrackers Global Dynamic FX Hedged Model (TR) DWSGLOBAL.TR

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| Xtrackers CSI 300 China A-Shares Hedged Equity ETF TR | ASHX.TR | 20.000% | 1.3439 | 03/30/2020 |

| Xtrackers Harvest CSI 300 China A-Shares ETF TR | ASHR.TR | 20.000% | 0.7591 | 03/23/2020 |

| Xtrackers MSCI All China Equity ETF TR | CN.TR | 20.000% | 3.2952 | 03/09/2020 |

| Xtrackers Russell 1000 US Quality at a Reasonable Price ETF TR | QARP.TR | 20.000% | 1.7251 | 02/03/2020 |

| Xtrackers MSCI USA ESG Leaders Equity ETF TR | USSG.TR | 20.000% | 1.0486 | 02/03/2020 |

* - Dates prior to 9/6/2016, which is when the Xtrackers Global Model Portfolio became available in the DWS Weekly ETF Report, are representative of when the position was added to the backtested model.

Xtrackers Global ex-US Dynamic FX Hedged Model (TR) DWSALLWORLDEXUS.TR

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| Xtrackers MSCI Japan Hedged Equity ETF Total Return | DBJP.TR | 25.000% | 2.5859 | 03/23/2020 |

| Xtrackers CSI 300 China A-Shares Hedged Equity ETF TR | ASHX.TR | 25.000% | 1.3439 | 03/09/2020 |

| Xtrackers MSCI All China Equity ETF TR | CN.TR | 25.000% | 3.2952 | 12/29/2017 |

| Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF TR | EMSG.TR | 25.000% | 3.4340 | 02/03/2020 |

* - Dates prior to 9/6/2016, which is when the Xtrackers All World Ex US Model Portfolio became available in the DWS Weekly ETF Report, are representative of when the position was added to the backtested model.

Xtrackers Developed ex-US Dynamic FX Hedged Model (TR) DWSDEVINTL.TR

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| Xtrackers MSCI EAFE Hedged Equity ETF Total Return | DBEF.TR | 33.333% | 2.1514 | 07/22/2019 |

| Xtrackers MSCI Eurozone Hedged Equity ETF Total Return | DBEZ.TR | 33.333% | 1.3638 | 06/24/2016 |

| Xtrackers MSCI Japan Hedged Equity ETF Total Return | DBJP.TR | 33.333% | 2.5859 | 03/23/2020 |

* - Dates prior to 9/6/2016, which is when the Xtrackers Developed Intl Equity Model Portfolio became available in the DWS Weekly ETF Report, are representative of when the position was added to the backtested model.