It is 20 years today that Nike has been on an RS buy signal. Take a look at other S&P 1500 stocks that have been on a long term RS buy signal.

One of the factors that impacts the calculation of the technical attribute rating is market relative strength. Relative strength signals are longer term indications of performance trends within the marketplace; you can increase your odds of success by holding on to stocks exhibiting long-term relative strength versus the market. One of the stocks in this category is NIKE, Inc. NKE. Today, NKE celebrated its 20th anniversary of its market RS buy signal. Since 12/22/2000, shares of Nike have gained a whopping 2126.3% while the S&P 500 Index SPX and S&P Equal Dollar Weighted Index SPXEWI are up 182.35% and 324.82%, respectively (through 12/22/2020).

Yesterday (12/21), shares of NKE rallied close to $148, printing a new all-time high for the stock. Nike is a 4 for 5’er with an overbought reading of 74% putting it into heavily overbought territory. From here, support is offered at $126.

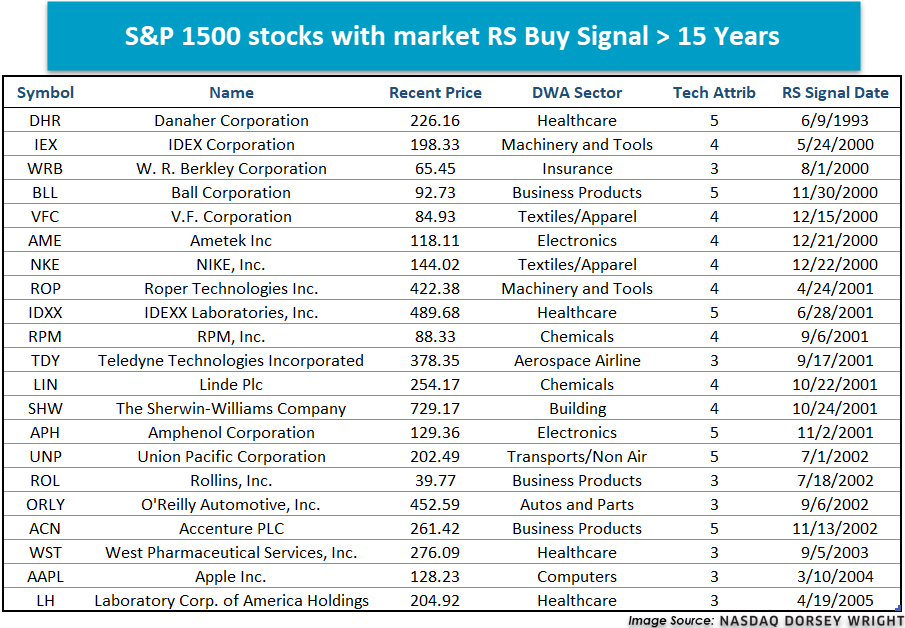

Below, we have compiled a list of stocks in the S&P 1500 universe that also have been on a long-term RS buy signal for at least 15 years. The technical criteria to make the list includes having a TA rating of 3, 4, or 5, trading in a positive trend, and being on a market buy signal for at least 780 weeks (15 years). There are 21 names that meet these criteria with Danaher Corporation DHR being the longest running market RS buy signal.