Daily Summary

Strength Within Each Sector: Do the Generals or Soldiers Lead?

Where does strength reside the most within each sector, and where has it been moving as of late?

NDW Prospecting: Actionable Ideas in International Equities

We examine four actionable international equity ETFs.

Weekly Video

Weekly Rundown Video – Feb 25, 2026

Weekly rundown with NDW analyst team covering all major asset classes.

Weekly rundown with NDW analyst team covering all major asset classes.

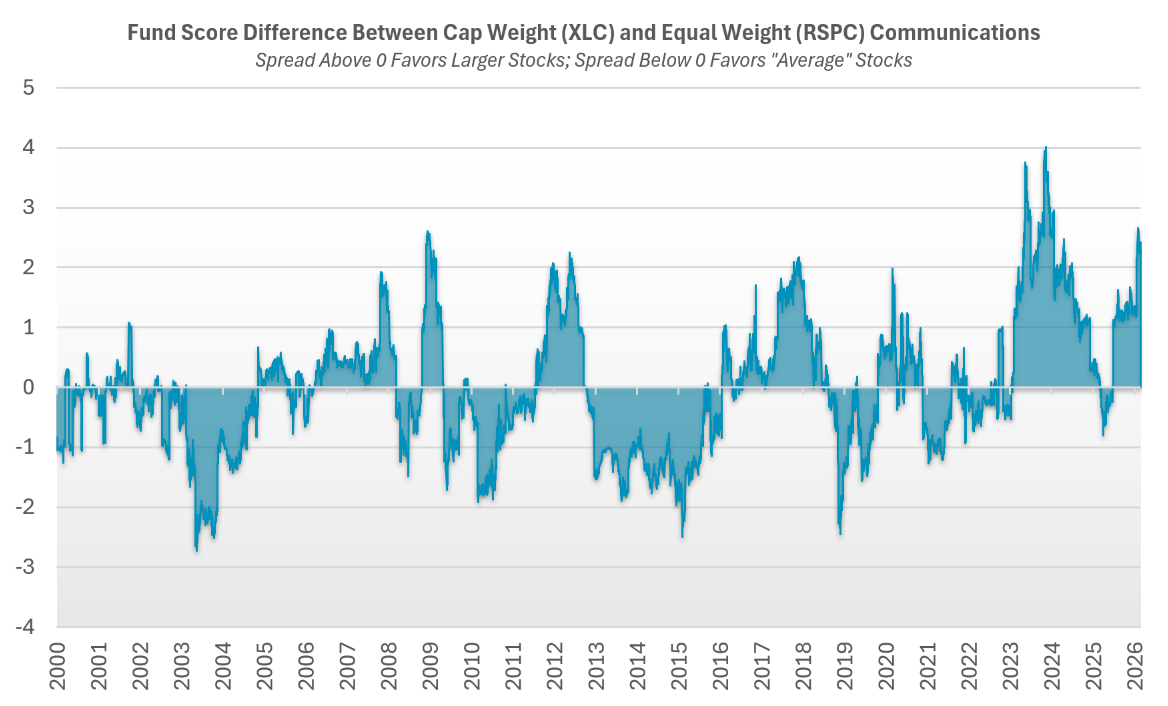

On a battlefield, victory depends on the combined efforts of both the soldiers and the general leading them. Similarly, markets can move higher at the hands of either its largest companies (generals) or the average sized stocks (soldiers) that make up the majority of companies. So far in 2026, the soldiers have led the way to the upside, which is a continuation of movement we saw at the end of 2025. These differences are magnified even further when breaking down the market into sectors. The cap weight State Street Communications Select Sector SPDR ETF (XLC) has gained 4.5% over the last six months. However, the Invesco S&P 500 Equal Weight Communication Services ETF, representing the average communications stock, is down 2.7% over that same span.

Watchful investors would have seen that XLC held a higher fund score than RSPC over that entire year’s period, highlighting the importance of monitoring where strength lies in a sector. With all that in mind, where does strength reside the most within each sector, and where has it been moving as of late? Looking at the table below of different equal and cap weight ETFs, the eleven major sectors can be split into three major categories: top heavy sectors, bottom heavy sectors, and those lying somewhere in the middle.

The Middle Ground:

Currently, there is little to no difference between the largest and average stocks within the following sectors: Industrials, Utilities, Healthcare, Energy, and Staples. Investors adding exposure to these areas shouldn’t think too hard about whether to favor the sectors’ leaders or its average joes.

The Top Heavy Sectors:

In Financials, Communications, and Real Estate, strength is more concentrated in the larger stocks, while smaller names tend to lag. Communications and real estate have seen their cap weight funds outperform this year, whereas financials has seen downside from some the largest financial institutions.

Communications clearly holds the greatest lead in favor of cap weight areas relative to any sector, with XLC doubling RSPC’s fund score, but that makes more sense given its constituents. Nearly two fifths of XLC’s allocation is solely in Alphabet (GOOGGOOGL) and Meta Platforms (META), so the strength of those two companies is buoying the sector on a cap weighted basis for the time being. Overall, investors targeting these sectors may benefit from emphasizing the larger names.

The Bottom Heavy Sectors:

Strength from the Consumer Discretionary and Technology sectors is more likely to be found among the average stocks compared to the the largest names. The two equal weight sector funds hold strong scores and are positive in 2026. Conversely, cap weight representatives for these sectors are down YTD and hold mediocre fund scores below 3.8.

Technology has been propelled by its mega‑cap leaders for several years, making the recent weakness in those names particularly notable. In fact, the difference in fund score between XLK and RSPT reached the widest spread in favor of average tech stocks in nearly 20 years. The only sustained periods favoring RSPT over XLK are the first half of the 2000s, the mid-2010s, and 2020/2021. While the sector is holding up for now, a deeper decline among technology’s generals would be an important development to monitor as we look ahead to the rest of 2026.

As we have discussed previously, international equities now rank first in the DALI asset class rankings after overtaking domestic equities earlier this month. For those who use for allocation guidance, this means increasing our exposure to international equities. Unfortunately, much of international equities has been heavily extended for most of 2026 and remains so today – the iShares MSCI Emerging Market ETF (EEM) has a weekly overbought/oversold (OBOS) reading of 129% while the iShares MSCI EAFE ETF (EFA) has a weekly OBOS reading of 114% - which has made it challenging to find an opportune entry points. To help make the process easier, today we have identified four technically strong ETFs that are actionable around current levels.

The iShares MSCI Chile ETF (ECH)

One of the strongest candidates on our list is the iShares MSCI Chile ETF (ECH), which in addition to having a favorable technical picture and trading in actionable territory also has a favorable setup on its default trend chart.

Earlier this month, ECH formed, but didn’t break a double top at $47.50 and then broke a double bottom at $45. In Tuesday’s trading (2/24) ECH reversed up into a column of Xs on its chart, entering the action phase of a potential shakeout pattern, which would be completed with a triple top break at $47.50.

In addition to the recent chart action, ECH has a strong overall technical picture – it currently has a near-perfect 5.72 fund score, which is 1.0 points better than the average for all non-US equity funds, and a positive 1.36 score direction. ECH also currently ranks seventh out of 45 names in the World ETF Matrix.

While much of the international market is heavily overbought, ECH sits well within actionable territory with a weekly OBOS reading of 30%. Short-term investors may consider $42.50 as a potential stop as a move to this level would negate the potential shakeout pattern; beyond this level the next support on ECH’s chart sits at $36. Year-to-date (through 2/25) ECH has gained 10.72% on a price return basis; the fund also carries a 1.8% yield.

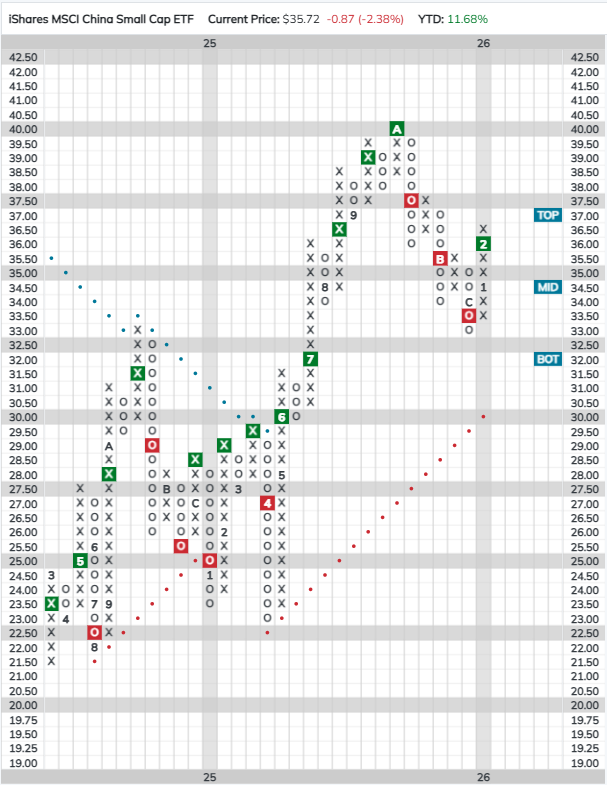

The iShares MSCI China Small Cap ETF (ECNS)

After declining more than 15% and giving three consecutive sell signals from September through December, the ECNS returned to a buy signal earlier this month when it completed a bearish signal reversal at $36.

ECNS currently has a favorable 4.02 fund score, which lags the average for all non-US equity funds, but is better than the average for all China-focused funds. The fund had reached heavily overbought territory, but a pullback on Thursday (2/26) has put ECNS back within actionable territory – as of Thursday afternoon the fund had a weekly OBOS reading of roughly 45%. Initial support can be found at $33, with additional support at $30, where ECNS’s bullish support line also currently sits. Year-to-date, ECNS has gained 11.68% on a price return basis; the fund also carries a 5.7% yield.

The Global X MSCI Greece ETF (GREK)

On its default chart, GREK has given two consecutive buy signals and reached an all-time high in January. The fund has subsequently pulled back to near the middle of its trading band, with a weekly OBOS reading of 11.8%. GREK now sits just above prior resistance, which may act as support; beyond the prior resistance at $70, support can be found at $66 and $62.

GREK currently has a strong 5.51 fund score, which is 0.69 points better than the average for all non-US equity funds; it also ranks sixth in the World ETF Matrix, just ahead of ECH. Year-to-date, GREK has gained 8.5% on a price return basis and also carries a 3.1% yield.

The iShares MSCI Ireland ETF (EIRL)

On its default chart, EIRL has given four consecutive buy signals, most recently completing a bullish catapult in November of last year. The fund reached a new all-time high earlier this month before pulling back to just above prior resistance and currently sits near the middle of its trading band, putting in well within actionable territory.

EIRL has a strong 4.92 fund score and has been on a market RS buy signal since 2023 and trading in a positive trend since 2022. Year-to-date, EIRL is flat on a price return basis and carries a 2.7% yield.

International equities have continued to outperform their domestic counterparts in 2026, but the strong performance has pushed broad international funds into heavily extended territory. We often see stocks and funds in strong uptrends become overbought and continue higher. But, for those who prefer less-extended options all of the funds highlighted above are viable candidates.

Average Level

44.06

| < - -100 | -100 - -80 | -80 - -60 | -60 - -40 | -40 - -20 | -20 - 0 | 0 - 20 | 20 - 40 | 40 - 60 | 60 - 80 | 80 - 100 | 100 - > |

|---|---|---|---|---|---|---|---|---|---|---|---|

| < - -100 | -100 - -80 | -80 - -60 | -60 - -40 | -40 - -20 | -20 - 0 | 0 - 20 | 20 - 40 | 40 - 60 | 60 - 80 | 80 - 100 | 100 - > |

| AGG | iShares US Core Bond ETF |

| USO | United States Oil Fund |

| DIA | SPDR Dow Jones Industrial Average ETF |

| DVY | iShares Dow Jones Select Dividend Index ETF |

| DX/Y | NYCE U.S.Dollar Index Spot |

| EFA | iShares MSCI EAFE ETF |

| FXE | Invesco CurrencyShares Euro Trust |

| GLD | SPDR Gold Trust |

| GSG | iShares S&P GSCI Commodity-Indexed Trust |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF |

| ICF | iShares Cohen & Steers Realty ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. Bond ETF |

| IJH | iShares S&P 400 MidCap Index Fund |

| ONEQ | Fidelity Nasdaq Composite Index Track |

| QQQ | Invesco QQQ Trust |

| RSP | Invesco S&P 500 Equal Weight ETF |

| IWM | iShares Russell 2000 Index ETF |

| SHY | iShares Barclays 1-3 Year Tres. Bond ETF |

| IJR | iShares S&P 600 SmallCap Index Fund |

| SPY | SPDR S&P 500 Index ETF Trust |

| TLT | iShares Barclays 20+ Year Treasury Bond ETF |

| GCC | WisdomTree Continuous Commodity Index Fund |

| VOOG | Vanguard S&P 500 Growth ETF |

| VOOV | Vanguard S&P 500 Value ETF |

| EEM | iShares MSCI Emerging Markets ETF |

| XLG | Invesco S&P 500 Top 50 ETF |

Long Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| GS | Goldman Sachs Group, Inc. | Wall Street | $921.38 | mid-800s - mid-900s | 1416 | 736 | 5 TA rating, top 10% of WALL sector matrix, LT RS buy, LT pos trend, buy-on-pullback |

| PHM | PulteGroup, Inc. | Building | $134.61 | hi 120s - mid 130s | 168 | 110 | 4 for 5'er, top half of BUIL sector matrix, LT pos peer & mkt RS, bullish catapult |

| CBOE | CBOE Global Markets Inc. | Wall Street | $291.27 | lo 260s - mid 280s | 332 | 228 | 5 TA rating, top 25% of WALL sector matrix, LT RS buy, LT pos trend, buy-on-pullback |

| JBL | Jabil Circuit, Inc. | Electronics | $277.57 | mid 240s- lo 270s | 352 | 204 | 4 TA rating, top 50% of ELEC sector matrix, LT RS buy, buy-on-pullback, Earn. 3/19 |

| ABBV | AbbVie Inc. | Drugs | $226.92 | 210s - low 230s | 284 | 188 | 5 for 5'er, favored DRUG sector, LT pos peer & mkt RS, breakout from consec sell signals, 2.9% yield |

| AB | AllianceBernstein Holding LP | Wall Street | $39.82 | low 40s | 64 | 32 | 3 TA rating, LT mkt RS buy, LT pos trend, top 50% of WALL sector matrix, consec buy signals, buy-on-pullback, yield > 8% |

| SN | SharkNinja, Inc. | Household Goods | $128.90 | 120s - low 130s | 183 | 108 | 4 for 5'er, 3rd of 28 in HOUS sector matrix, multiple buy signals, buy on pullback, R-R>2.0 |

| BYD | Boyd Gaming Corp | Gaming | $84.93 | 82 - 88 | 98 | 72 | 4 for 5'er, top 20% of GAME sector matrix, LT pos peer RS, triple top, pos trend flip, buy on pullback |

| PKG | Packaging Corp of America | Forest Prods/Paper | $230.92 | hi 200s - mid 230s | 358 | 184 | 4 TA rating, top 20% of FORE sector RS matrix, LT RS buy, buy-on-pullback |

| CPA | Copa Holdings SA | Aerospace Airline | $147.94 | 140s | 166 | 124 | 4 for 5'er, top half of favored AERO sector matrix, LT pos mkt RS, bullish catapult, 4.8% yield |

| ZWS | Zurn Elkay Water Solutions Corp. | Machinery and Tools | $50.63 | hi 40s - lo 50s | 95 | 42 | 5 TA rating, LT pos trend, LT mkt RS buy, consec buy signals, buy-on-pullback |

Short Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|

Follow-Up Comments

| Comment | |||||||

|---|---|---|---|---|---|---|---|

|

|

|||||||

NDW Spotlight Stock

ZWS Zurn Elkay Water Solutions Corp. ($50.83) R - Machinery and Tools - ZWS has a 5 for 5 TA rating and sits in the top half of the favored machinery and tools sector RS matrix. The stock has maintained a positive trend since 2023 and been on an RS buy signal against the market since 2018, highlighting the long-term technical strength. The recent chart action saw ZWS retract from all-time highs toward the middle of its trading band, offering potential long investors a better entry point. Exposure may be considered on this pullback in the high $40s to low $50s. Our initial stop will be positioned at $42, which would violate multiple support levels on the more sensitive 1/2 point chart. The bullish price objective of $95 will serve as our price target, offering a reward-to-risk ratio north of 4-to-1.

| 23 | 24 | 25 | 26 | ||||||||||||||||||||||||||

| 53.00 | X | 53.00 | |||||||||||||||||||||||||||

| 52.00 | X | O | 52.00 | ||||||||||||||||||||||||||

| 51.00 | X | O | 51.00 | ||||||||||||||||||||||||||

| 50.00 | X | X | O | 50.00 | |||||||||||||||||||||||||

| 49.00 | A | O | 2 | 49.00 | |||||||||||||||||||||||||

| 48.00 | X | O | X | X | Mid | 48.00 | |||||||||||||||||||||||

| 47.00 | 9 | O | X | O | X | 47.00 | |||||||||||||||||||||||

| 46.00 | X | B | X | O | X | 46.00 | |||||||||||||||||||||||

| 45.00 | 8 | O | 1 | 45.00 | |||||||||||||||||||||||||

| 44.00 | X | 44.00 | |||||||||||||||||||||||||||

| 43.00 | X | 43.00 | |||||||||||||||||||||||||||

| 42.00 | X | Bot | 42.00 | ||||||||||||||||||||||||||

| 41.00 | C | X | 41.00 | ||||||||||||||||||||||||||

| 40.00 | X | O | X | 40.00 | |||||||||||||||||||||||||

| 39.00 | B | O | X | X | 39.00 | ||||||||||||||||||||||||

| 38.00 | X | O | X | O | 7 | 38.00 | |||||||||||||||||||||||

| 37.00 | A | O | X | O | X | 37.00 | |||||||||||||||||||||||

| 36.00 | X | 1 | 2 | X | 36.00 | ||||||||||||||||||||||||

| 35.00 | • | X | O | 5 | 35.00 | ||||||||||||||||||||||||

| 34.00 | • | 4 | X | 3 | X | 34.00 | |||||||||||||||||||||||

| 33.00 | • | X | O | X | 9 | O | X | • | 33.00 | ||||||||||||||||||||

| 32.00 | X | • | • | X | O | 7 | O | X | 4 | X | • | 32.00 | |||||||||||||||||

| 31.00 | X | X | O | 8 | • | 2 | O | X | O | X | O | X | • | 31.00 | |||||||||||||||

| 30.00 | 6 | O | 7 | O | X | O | • | X | X | 6 | X | 8 | O | X | • | 30.00 | |||||||||||||

| 29.00 | X | O | X | O | X | O | • | X | O | B | O | O | X | • | 29.00 | ||||||||||||||

| 28.00 | X | O | X | O | X | O | • | 7 | O | X | O | • | 28.00 | ||||||||||||||||

| 27.00 | X | O | O | 9 | • | X | A | X | • | • | 27.00 | ||||||||||||||||||

| 26.00 | O | X | O | • | 26.00 | ||||||||||||||||||||||||

| 25.00 | • | O | B | X | X | • | 25.00 | ||||||||||||||||||||||

| 24.00 | • | A | X | O | 2 | O | 6 | • | 24.00 | ||||||||||||||||||||

| 23.00 | • | O | X | O | X | O | 5 | • | 23.00 | ||||||||||||||||||||

| 22.00 | • | O | C | X | 3 | 4 | • | 22.00 | |||||||||||||||||||||

| 21.00 | • | O | O | X | • | 21.00 | |||||||||||||||||||||||

| 20.00 | O | X | • | 20.00 | |||||||||||||||||||||||||

| 19.50 | O | • | 19.50 | ||||||||||||||||||||||||||

| 23 | 24 | 25 | 26 |

| ASO Academy Sports and Outdoors, Inc. ($61.51) - Retailing - ASO broke a double top at $62 to complete a bullish catapult and count as a fifth consecutive buy signal since December last year while marking the highest chart level since late 2024. The stock improved to a 3 for 5'er earlier this month after seeing the peer RS chart return to a column of Xs, and the stock now ranks within the top quartile of the Retailing sector matrix. Okay to consider here on the breakout. Notable support can be found in the upper to mid $50 with the bullish support line sitting at $54. |

| AVGO Broadcom Ltd ($317.23) - Semiconductors - AVGO fell Thursday to break a double bottom at $312 before dropping to $308 intraday. This 2 for 5'er moved to a negative trend earlier this month and sits in the bottom quintile of the semiconductor sector RS matrix. The weight of the technical evidence is weak and deteriorating. Further support may be seen at $296. Overhead resistance can be seen initially at $332. Earnings are expected on 3/4. |

| CAT Caterpillar, Inc. ($751.90) - Machinery and Tools - Quick comment today serving as a reminder that the first sell signal in an otherwise strong uptrend is typically not the end of the rally. CAT is normalizing out of heavily overbought territory on its default chart, leaving resistance between $776 & $784 above. Towards the downside, look to old resistance at $720 or support just above the middle of the trading band in the low $670's. |

| JLL Jones Lang LaSalle Incorporated ($322.73) - Real Estate - Shares of JLL have fallen sharply over the last several weeks, falling down to a 2 for 5'er after moving to a negative trend and losing near-term relative strength. However, it has rebounded slightly, breaking a double top $324 to move back to a buy signal. That said, those with positions could sell it here given its loss in strength. From here, the bearish resistance line lies at $340. |

| NFLX NetFlix Inc. ($85.04) - Media - Despite the break higher today, the technical picture remains quite weak. You'll note a range of resistance around current levels (as well as the 50-day) that would suggest things could run out of steam roughly around current levels. To boot, the stock isn't close to picking up further technical favor against its peer group or the broader market,... leaving it stuck in a "sell" territory for the time being. |

| SRE Sempra Energy ($95.82) - Gas Utilities - SRE reversed into Xs and broke double top at $96 for a second buy signal and to clear resistance at $95 as shares rallied to $97, marking a new all-time chart high. The stock has been a 3 for 5'er since October 2025 and maintains positive near-term relative strength against the market and its peer group. Okay to consider here on the breakout or on a pullback to the mid $90s. Initial support lies at $92, while additional can be found in the mid to lower $80s. |

| STT State Street Corporation ($133.04) - Wall Street - STT shares moved higher today to break a double top at $132 to mark its first buy signal. This 5 for 5'er has been in a positive trend since May and on an RS buy signal versus the market since November. STT shares are actionable at current levels with a weekly overbought/oversold reading of 8%. From here, support is offered at $124. |

| VAL Valaris Ltd. ($94.49) - Oil Service - VAL fell to a sell signal Thursday when it broke a double bottom at $92. The outlook for the stock remains positive as VAL is a 4 for 5'er that ranks fourth of 75 names in the oil service sector matrix. From here, the next level of support sits at $89. |

| WHD Cactus, Inc. Class A ($51.42) - Oil Service - WHD was down more than 11% on Thursday and gave an initial sell signal when it broke a double bottom at $53. The technical picture for WHD remains moderately positive as it is a 3 for 5'er and ranks in the top third of the oil service sector matrix. From here, the next level of support on WHD's chart sits at $44. |

Daily Option Ideas for February 26, 2026

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Citigroup, Inc. - $116.55 | C2618F120 | Buy the February 120.00 calls at 7.45 | 106.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| Monster Beverage Corp. ( MNST) | Mar. 77.50 Calls | Raise the option stop loss to 7.40 (CP: 9.40) |

| Amphenol Corporation ( APH) | Apr. 150.00 Calls | Stopped at 9.60 (CP: 8.90) |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Mosaic Company - $27.15 | MOS2618R25 | Buy the June 25.00 puts at 1.59 | 32.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

|

|

||

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| Micron Technology, Inc. $ 429.00 | MU2618F420 | Jun. 420.00 | 64.05 | $ 177,673.30 | 55.00% | 53.87% | 14.29% |

Still Recommended

| Name | Action |

|---|---|

| Intel Corporation ( INTC) - 46.88 | Sell the May 49.00 Calls. |

| The Gap, Inc. ( GAP) - 27.18 | Sell the March 29.00 Calls. |

| Enphase Energy Inc ( ENPH) - 48.49 | Sell the April 50.00 Calls. |

| Target Corporation ( TGT) - 116.44 | Sell the May 115.00 Calls. |

| Delta Air Lines Inc. ( DAL) - 69.38 | Sell the April 70.00 Calls. |

| Freeport-McMoRan Inc. ( FCX) - 68.82 | Sell the June 65.00 Calls. |

| Carnival Corporation ( CCL) - 31.70 | Sell the April 33.00 Calls. |

| Kinross Gold Corporation ( KGC) - 36.04 | Sell the April 36.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

|

|

|