With no changes to any of the iShares models this week, we look at the iShares China Large Ca ETF ([FXI]).

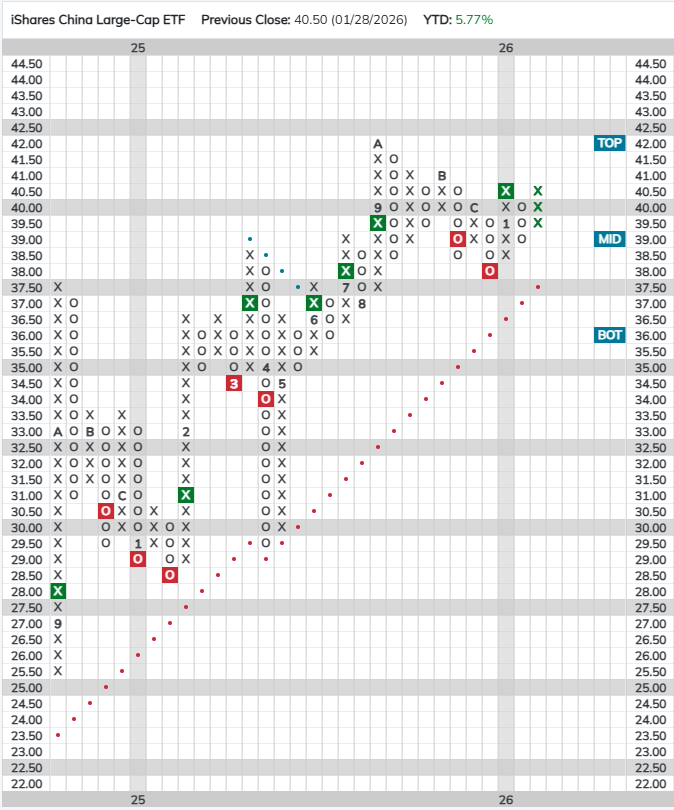

There are no changes to any of the iShares models this week. International equities have continued to outpace domestic stocks thus far in 2026; year-to-date (through 1/28) iShares MSCI ACWI ex US ETF (ACWX) has gained 6.82% outpacing the S&P 500 (SPX) by almost 5%. Investors looking to add international exposure may wish to consider the iShares China Large Cap ETF (FXI). After giving two consecutive sell signals late last year, FXI returned to a buy signal earlier this month with a double top break at $40.50 and sits one box away from giving a second consecutive buy signal. The fund has established multiple levels of support in the $37 - $39 range and its bullish support line currently sits at $37.50.

FXI currently has an acceptable 3.91 fund score. Year-to-date (through 1/28) FXI has gained 5.77% on a price return basis; the fund also carries a 2.4% yield.