There is a change to the Invesco Special Opportunities Model (GUGGSO) this week.

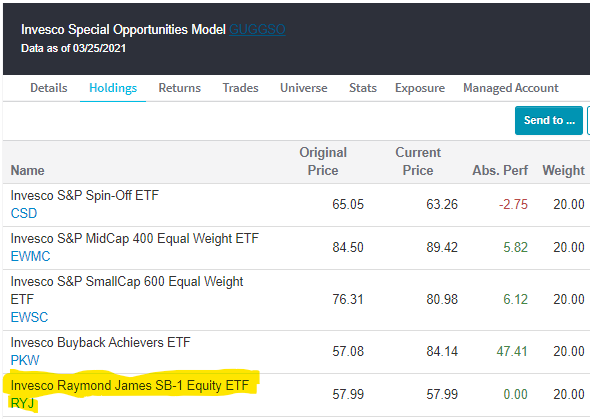

There is a change to the Invesco Special Opportunities Model GUGGSO this week. Sell the Invesco China Technology ETF CQQQ and buy the Invesco Raymond James SB-1 Equity ETF RYJ. CQQQ was removed because its rank in the model’s relative strength matrix fell below the threshold to remain a holding in the model. In place of CQQQ, the model added RYJ as it was the highest-ranking fund in the matrix that was not already a holding in the portfolio. This is the fourth change to the model this year.

RYJ tracks an index of US-listed equity securities rated Strong Buy 1 by Raymond James & Associates, Inc. RYJ currently has a strong 4.79 fund score, 1.07 points better than the average for all growth and income funds, and a positive 1.39 score direction. RYJ’s three largest sector exposures are financials (23.10%), healthcare (17.25%), and technology (14.76%).

On its default chart, RYJ has given two consecutive buy signals and reached a new all-time high earlier this month before pulling back to the middle of its trading band. Year-to-date (through 3/26) RYJ has gained 13.86% on a price return basis, while the S&P 500 SPX is up 5.82%. In addition to RYJ, GUGGSO also has exposure to spin-offs, mid cap equities, small cap equities, and buybacks. Year-to-date the model has gained 7.30%.