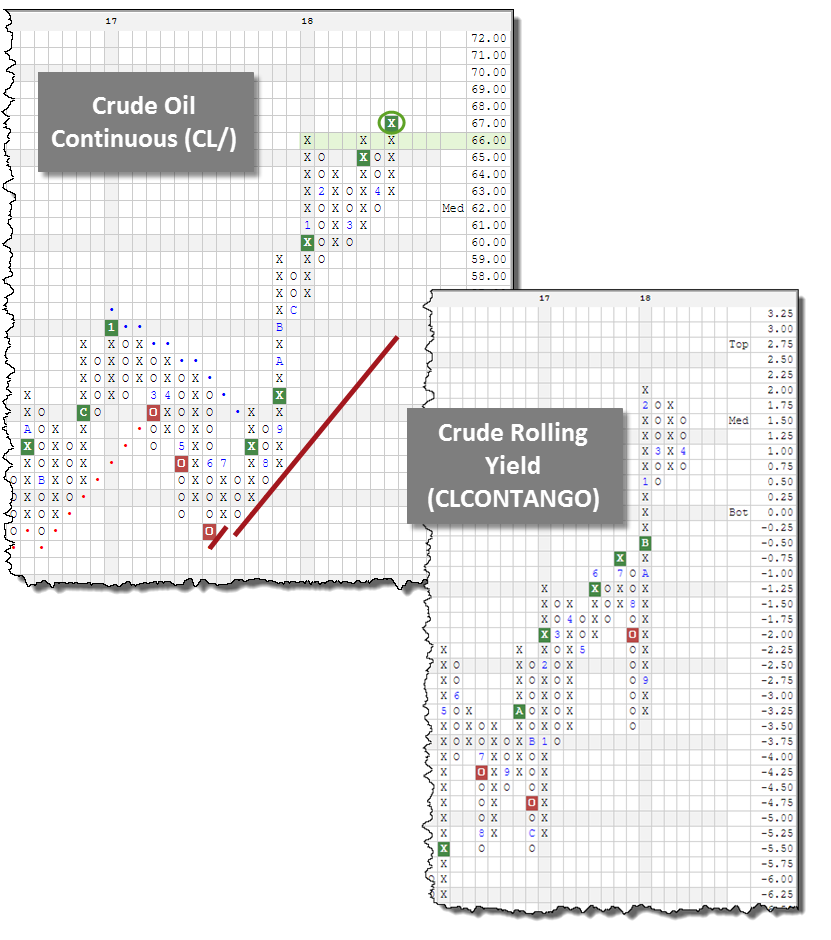

The improvement on the Crude Oil Continuous (CL/) chart has led us to dive into various ways to gain commodity related exposure via ETFs.

At the end of January 2018, we witnessed the Commodities asset class overtake Fixed Income for the third place position in the DALI rankings. Those of you following Tactical Tilt may have witnessed this move, but it most likely did not alter your portfolio allocation as a result of the continued strength in US and International Equities. For others, it may have piqued your interest to begin seeking opportunities within the asset class. One of the reasons for the bump in the Tally Ranking for Commodities is the general improvement within the Energy sector. By looking at the historical tally, you can see Energy rose from 4th to 1st among the Commodity sub-asset ranks all within the 4th quarter of 2017. This is a trend that has continued throughout the course of 2018 thus far. Energy from a Commodity perspective is rising the ranks across the DWA platform. The fuel behind Energy’s gains has been the rise of Oil.

If we look to the Crude Oil Continuous CL/ chart for reference, we can see the chart has continued to improve throughout 2018 and currently trades at multi-year highs having broken a spread triple top at $67. We’ve also witnessed funds like the PowerShares DB Oil Fund DBO crack the top 10 in the premade Asset Class Matrix having overtaken a few US Equities like the Equal Weight S&P 500 RSP, Total Stock Market VTI, and S&P 500 Top 50 XLG. So not only are we seeing improvement from an absolute basis but a relative basis as well. Today we will explore ways to gain exposure to Commodity related Oil securities and dissect how their structure may impact your portfolios.

Oil Exposure Through ETFs:

1) United States 12 Month Oil Fund USL

- Track: Near-Month Futures Contract and the following 11 consecutive months

- Futures Owned: June 2018 and 11 consecutive months following

- Expense Ratio: 79 basis points

- Assets: $84 Million

- K-1: Yes

- Comment: USL has a fund score of 4.77 and it recently completed a bullish catapult formation by breaking a double top at $23 following the triple top break at $20.50 in December. New positions could be initiated here or on a pullback. Support is offered at $20.50 and in the lower $19s.

2) United States Oil Fund USO

- Track: Near-Month Futures Contract

- Futures Owned: June 2018

- Expense Ratio: 72 basis points

- Assets: $1.90 Billion

- K-1: Yes

- Comment: USO also comes with a solid fund score at 4.79. On the default chart shown below, we can see the fund was able to penetrate the bearish resistance line on January 9th of this year and has since gone on to break a triple top at $13.50 on April 11th.The chart has also experienced a recent flip to positive weekly momentum. Those seeking exposure could initiate positions at current levels and look to support at $12.50 and $11.75 from here.

3) PowerShares DB Oil Fund DBO

- Track: Optimum Futures Contract

- Futures Owned: February 2019

- Expense Ratio: 75 basis points

- Assets: $351 Million

- K-1: Yes

- Comment: DBO boasts the strongest fund score of the group, coming in at 5.87. Looking to the more sensitive 0.125 per box chart shown below, we can see the fund was able to re-enter a positive trend in January 2018 and completed a bullish triangle pattern at $11 in March. DBO rallied further and recently broke a double top at $11.375 this month. Those interested in long exposure may consider new positions at current levels where a move to $10.75 would mark the first sign of trouble, a double bottom break.

For those seeking broad Commodity exposure Without a K-1

PowerShares Optimum Yield Diversified Commodity Strategy No K-1 Portfolio PDBC

- Track: Diversified (14 Different) Commodities

- Futures Owned: Various Months Depending on Commodity

- Expense Ratio: 59 basis points

- Assets: $1.2 Billion

- K-1: No

- Comment: PDBC has a fund score of 4.08 and it has a bullish price objective of $24.25, which indicates the potential for continued price appreciation from current levels. The fund was able to move back into a positive trend back in September 2017 at $16.75 and more recently completed a triple top break this month at $18.25. It also provides a yield of 3.70%. Those seeking long exposure without having to generate a K-1 may consider PDBC at current levels and look to support at $17 and in the mid $16s.

It's important to remember that the Crude Oil market find itself in a state of backwardated. This tells us people are willing to pay a lower price for Crude at some point in the future than they are today for various reasons depending on the circumstances. If the market moves into contango, some funds are structured in such a way that they have to roll the contracts to a future month at a higher price and thus will suffer compared to those that do not. This is not to say that the performance will be negative, just that it is unlikely to perform as well as a fund that is able to choose a specific month i.e. USL (rolls forward) compared to DBO (has freedom). Looking at the performance just so far this year, we can see DBO is up roughly 12.50% while USL is up about 10.50% leaving about a 200 basis point gap between the two. While the two have been able to outperform CL/ in the near term, over the long haul, the structure of these funds have not been able to keep up with the performance of Crude Oil Continuous given how this market has flipped back and forth between a contango and backwardation style environment. Those that wish to gain exposure to Oil via an ETF are best served to choose a fund like DBO at this point, but that could change in the future. What makes an option like PDBC attractive is that it offers a wider array of exposure to the Commodities asset class but is overweight Oil and does not come with a K-1. If you don’t wish to use these funds to gain access to unlevered futures contracts or open a futures account, you may be stuck having to buy an oil tanker and finding a nice hiding spot along the coast to make some money. If you have “an Oil Tanker Guy” – let us know!

(Editor's Note: We misstated that Oil was in contango, when in fact it still persists in a backwardated state.)